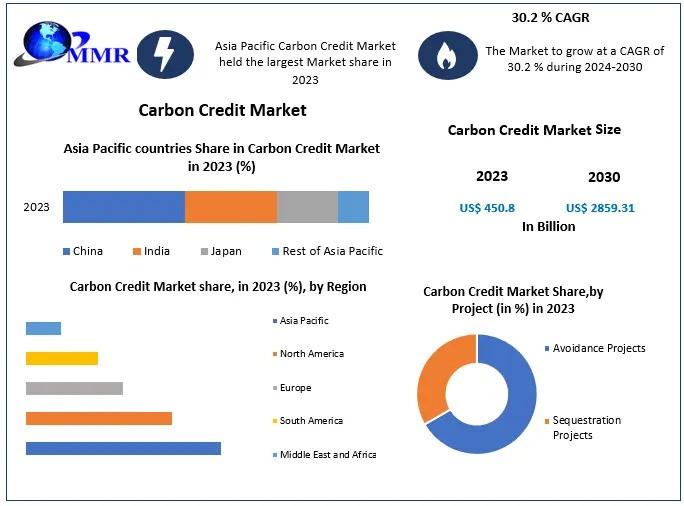

The size of the Carbon Credit Market was estimated at US$450.8 billion in 2023 and total Carbon Credit Market revenues are expected to grow by 30.2% between 2024 and 2030, reaching almost US$2859.31 billion in 2030.

Overview of the Carbon Credit Market

A crucial part of the global and national emissions trading programs designed to reduce global warming are carbon credits. Companies trade credits with each other or buy and sell them at the prevailing rate on world markets. Globally and among trading partners, credits are used to finance carbon reduction initiatives. A carbon credit is a document that authorizes the emission of one ton of greenhouse gases, such as carbon dioxide, by individuals, small, medium and large companies. When an organization reduces greenhouse gas emissions below a predetermined threshold, this happens. An impartial body issues the CO2 credit certification.

Get your sample PDF: https://www.maximizemarketresearch.com/request-sample/198127/

Market dynamics for carbon credits

Strengthening the focus on sustainability to expand the carbon credit market

The carbon credits market is expected to be driven by increasing corporate social responsibility and increased awareness among companies of the need to reduce greenhouse gas emissions to achieve net-zero emissions goals. Of all industrial sectors, the financial sector is the one actively involved in the development of the carbon credit market, having understood its potential. Financial institutions are adding carbon credits to their investment portfolios, setting up specialized funds and investing in carbon credit projects. The financial sector’s increased involvement in the market creates a revenue stream that improves transparency, attracts new capital and is expected to drive the expansion of the carbon credit market.

The carbon credit market is expected to be limited by price volatility.

The intrinsic price volatility of the carbon credit market is a barrier to its growth. Prices are unpredictable because they depend on a variety of factors, including market demand, regulatory changes and geopolitical events. Because returns on investments are unpredictable, companies and investors may be reluctant to participate in carbon credit transactions. Price fluctuations are also caused by the lack of a centralized global market and standardized pricing procedures. Due to the potential perception by stakeholders of this volatility as a financial risk, it poses a barrier to widespread adoption and makes it more difficult for the market to attract steady participation and investment.

Market segmentation of carbon credits

per project

Avoidance projects

Sequestration projects

by type

Compliance market

Voluntary Market

per application

Energy and power

Aviation

Transport

Industrial

Others

According to the filing, the highest share of the carbon credit market is expected to fall into the energy and electricity segment by 2023. The Paris Agreement’s emphasis on reducing greenhouse gas emissions has led to an increase in the number of renewable energy projects worldwide. The industrial sector is shifting from high-emission fossil fuel-based technologies to low-emission technologies that integrate renewable energy into their operating procedures due to the global shift to renewable energy sources such as solar, wind and hydropower. The main source of greenhouse gas emissions is energy and electricity production. These elements are expected to drive the growth of the power and energy segment of the carbon credit market.

For more information about this study, please visit the following web page: https://www.maximizemarketresearch.com/request-sample/198127/

Key Players in the Carbon Credit Market

1. BP target neutral

2. JPMorgan Chase & Co.

3. Gold standard

4. Carbon clear

5. Antarctic Group

6. 3 degrees

7. Scale

8. EcoAct

9. CBL Markets

10. Carbon Credit Capital

11. Climate care

12. VCS (Verified Carbon Standard)

13. Sindicatum Sustainable resources

14. Mercury Capital Advisors

15. Nori

16. Carbon Trust

17. Veridium Labs

18. Natural Capital Partners

19. EDF Trading

If you would like to know more about this research, click here: https://www.maximizemarketresearch.com/market-report/carbon-credit-market/198127/

Regional insights:

By 2023, the carbon credit market was dominated by Asia Pacific. China and India are home to the world’s most important automotive and other industries. These countries are home to a large number of emerging Carbon Credit Key Companies, such as Krish Hortus, The Green Meat and Emertech Innovations Pvt Ltd. These companies offer certificates and solutions related to carbon credit. The Asia Pacific market is expected to grow at a rapid pace due to these factors. The Energy Conservation Act of 2001 was enacted by the Indian government and served as the cornerstone of the market.

The key questions answered in the Carbon Credit market report are:

How has the Carbon Credit market performed so far and how will it perform in the coming years?

What is the market segmentation of the global Carbon Credit market?

What is the regional breakdown of the global Carbon Credit market?

What are the price trends of different commodities in the Carbon Credit industry?

What is the structure of the Carbon Credit industry and who are the key players?

What are the different unit activities involved in a Carbon Credit processing plant?

What is the total area of land required to set up a Carbon Credit processing plant?

What is the layout of a Carbon Credit processing plant?

What are the machine requirements for setting up a Carbon Credit processing plant?

What are the raw material requirements for setting up a Carbon Credit processing plant?

What are the packaging requirements for setting up a Carbon Credit processing plant?

What are the transportation requirements for setting up a Carbon Credit processing plant?

What are the utility requirements for setting up a Carbon Credit processing plant?

Main offers:

Market share, size and forecast by revenue|2022-2029

Market Dynamics – Growth Drivers, Constraints, Investment Opportunities and Key Trends

Market segmentation: a detailed analysis by Carbon Credit

Landscape- Leading key players and other prominent key players.

Our most popular trend reports:

Global Vehicle Access Control Market: https://www.maximizemarketresearch.com/market-report/global-vehicle-access-control-market/114796/

Global Medical Document Management Systems Market: https://www.maximizemarketresearch.com/market-report/global-medical-document-management-systems-market/6506/

Global Silage Additives Market: https://www.maximizemarketresearch.com/market-report/global-silage-additives-market/71491/

Global Lithium-Ion Battery Strap Market: https://www.maximizemarketresearch.com/market-report/global-lithium-ion-battery-binders-market/85277/

Global Food Grade Gases Market: https://www.maximizemarketresearch.com/market-report/global-food-grade-gases-market/28592/

Global Natural Food Preservatives Market: https://www.maximizemarketresearch.com/market-report/global-natural-food-preservatives-market/96311/

Global Alternative Sweeteners Market: https://www.maximizemarketresearch.com/market-report/global-alternative-sweeteners-market/21291/

Global Soy Derivatives Market: https://www.maximizemarketresearch.com/market-report/global-soybean-derivatives-market/96682/

Global Alcohol Ingredients Market: https://www.maximizemarketresearch.com/market-report/global-alcohol-ingredients-market/100022/

Global Hospital Linen Supply and Management Market: https://www.maximizemarketresearch.com/market-report/global-hospital-linen-supply-and-management-services-market/42510/

Contact Maximize Market Research:

3rd floor, Navale IT Park, phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is one of the fastest growing market research and business consulting firms serving clients worldwide. Our revenue impact and focused, growth-oriented research initiatives make us a proud partner of most Fortune 500 companies. We have a diversified portfolio and serve a variety of sectors such as IT and telecom, chemicals, food and beverage, aerospace and defense, healthcare and others.

This release was published on openPR.