Solar Media Market Research analyst Josh Cornes outlines the UK’s solar pipeline lined up to connect to the grid.

The UK government’s Clean Power 2030 Action Plan (CP30) is currently the main focus of the UK solar market, largely due to the insight it provides into the impact reforms can have on the grid connection queue.

With consultation well underway and guidelines being drawn up, developers are currently trying to determine their position in the queue and where to place their resources.

Looking at the built-in capacity registers (ECRs) of the distribution network operator (DNOs), the total solar capacity accepted for connection is approximately 70 GWp-dc. However, it is well known that a significant proportion of these are ‘zombie projects’ or projects that are at such an early stage of development that land may not yet be secured.

Figure 1: A breakdown of the UK solar pipeline at distribution level derived from the Utility-Scale Solar: UK Pipeline Database.

The top figure (49.9GWp-dc) shows the total capacity of projects at the distribution level that are in the consultation/scoping phase or in planning, whether submitted, approved or under construction.

The 18.1 GW just below this consists of projects that have no grid connection or projects that are behind the meter. Currently, there is a major focus on distribution-related projects, with around 36 GW of the targeted 47 GW allocated to them under current guidelines.

The remaining 11 GW comes from transmission-connected projects. The Transmission Entry Capacity (TEC) register currently counts more than 500 ‘installation type’ solar projects, with a combined capacity of just under 200 GW. It is known that a very large proportion of these are not intended to be built as solar, so the actual number is much smaller.

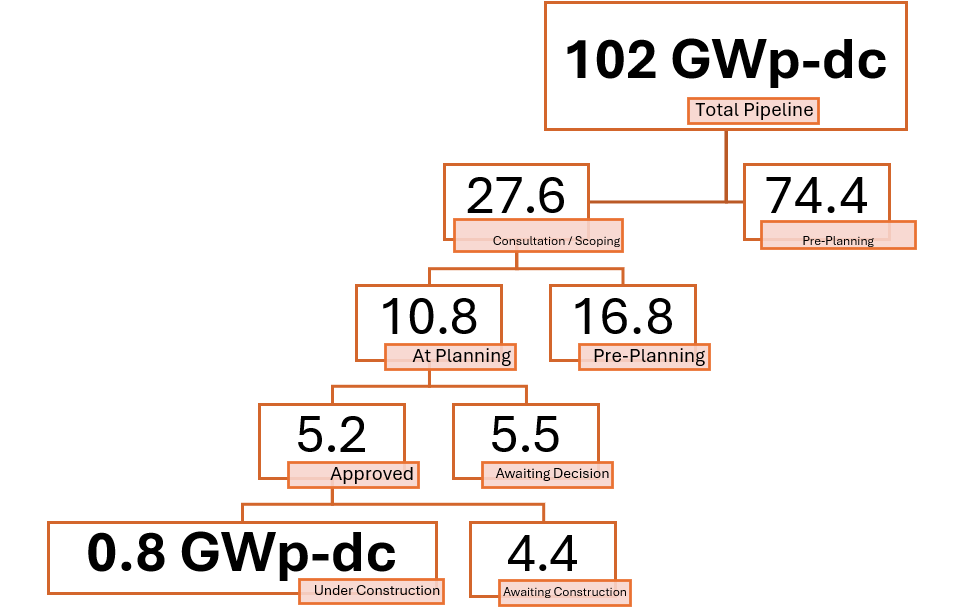

Figure 2: A breakdown of the UK solar pipeline at transmission level, derived from the Utility-Scale Solar: UK Pipeline Database.

As we can see from the above, the total UK pipeline is huge, currently 146 GW, either in planning or with grid connections at transmission level. Using Figure 1 and Figure 2 you can see that there are over 100 GW of transmission-connected projects using Grid in the UK. 27.6 GW is currently beyond that ‘skeptical’ stage and is becoming increasingly realistic, with almost 11 GW already in planning or further along.

It is important to remember that there are many more factors to consider than just the numbers above. An example of this is the capacity allocation per region in the United Kingdom. This makes it important to understand exactly where the above figures are concentrated and see if there are opportunities elsewhere in the country.

Another thing to consider is the available capacity at each grid delivery point (GSP). Some GSPs have currently accepted to connect in excess of 3GW, either in planning, consultation or on the TEC register, with Navenby and Staythorpe being the two most popular with 3.9GW and 3.1GW respectively.

Now that grid reform is just around the corner, it is crucial to understand what phase projects that already have a grid connection are in. With more than 70GWp-dc of ECRs, significant clean-up work will be required to create space for projects in the final stages of the planning process, with grid connection dates years later. With less focus on transmission-connected projects, almost all of the capacity to be realized before 2030 is already in planning, leaving little room for projects in the pre-planning phase.

For more information about the UK Pipeline Database email [email protected]