A new investigation into anti-dumping/countervailing duties (AD/CVD) could impact domestic production and deployment of lithium-ion energy storage and EV batteries in the United States.

In December 2024, the American Active Anode Material Producers (AAAMP) filed petitions with the Dept. of Commerce and the US International Trade Commission to obtain AD/CVD on the import of battery anode materials from China. AAAMP says China’s dominance in active anode material (AAM) production has prevented the domestic market from setting up competitive operations.

“Chinese industry’s use of unfair pricing is hurting American businesses and workers,” said Daniel Pickard, group leader of international trade and national security at Buchanan Ingersoll & Rooney and principal counsel for AAMP. “The domestic industry is committed to combating these unfair trade practices and ensuring that American manufacturing can compete on a level playing field.”

AAAMP is calling for duties on all active anode materials, synthetic, natural or a mixture; with or without coating; regardless of whether it is in powder, dry, liquid or any other form. The group has generalized that anode materials typically have a maximum size of 80 microns, an energy density of at least 330 milliampere-hours per gram, and a graphitization degree of 80% or more. The goods in question may or may not be mixed with silicon, but the graphite present must have a minimum purity of 90% carbon. The duties may be levied on anode materials whether imported individually, in a compound or in a completed battery.

The petition alleges dumping margins of 828% to 921%, but does not suggest specific subsidy rates.

The trade and the ITC have taken up the investigation and the ITC is expected to reach a preliminary decision on February 3, 2025. The trade would then make a preliminary CVD decision in March and a preliminary AD decision in May.

This case has already pitted EV and ESS manufacturers such as Panasonic and Tesla against the emerging domestic anode materials industry. Testimonies continue to be submitted to the International Court of Justice.

What are active anode materials?

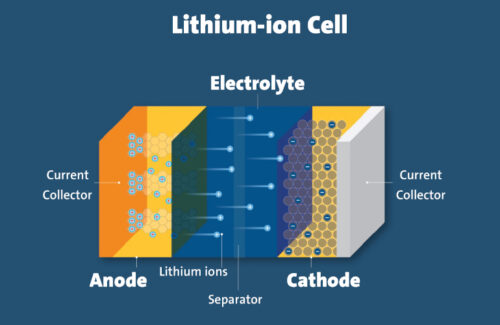

A battery needs both a cathode and an anode to facilitate the flow of electric charge. As the battery charges, electrons move from the positive cathode to the negative anode, and that electrical difference translates into stored energy. The stated ‘chemistry’ of a battery is actually the active cathode materials – lithium iron phosphate (LFP) or lithium-nickel-manganese-cobalt (NMC), for example. Active anode materials are typically carbon-based, such as graphite powder or silicon oxide. The materials are extracted, ground into a fine powder and then applied to the anode (usually copper foil).

How are active anode materials used in EV and ESS?

Although the United States produces graphite materials, it does not significantly produce the type of graphite used in active anode materials, which require specific particle size, density and purity. The AAAMP is calling for tariffs on Chinese AAM with a purity level of at least 90%, although the group is ultimately targeting AAM used in EV and ESS products.

Battery manufacturers enter into long-term purchasing agreements with AAM manufacturers and continuously conduct purity testing of the material. Tesla stated in court documents that it only uses AAM with a purity of 99.9% in its battery products, and that no domestic AAM producer can currently achieve that number.

What is the status of the domestic AAM market?

As with many energy-related products, China dominates the AAM market with an estimated 95% share. The production of non-Chinese graphite anode materials is publicly described as ‘nascent’.

Syrah’s AAM facility in Vidalia, Louisiana.

AAMP claims that it represents the only domestic manufacturers of active anode materials. Membership includes Anovion Technologies (Georgia), Syrah Technologies (Louisiana), NOVONIX Anode Materials (Tennessee), Epsilon Advanced Materials 5060 (North Carolina) and SKI US/Birla Carbon (Georgia/South Carolina). Most of these companies are still in the start-up phase. AAMP claims in its petition that the domestic AAM industry is struggling to get off the ground due to China’s oversupply.

This makes the AD/CVD research into anode materials different from the research into the import of solar panels. While the domestic solar panel manufacturing industry can show a clear “before” and “during/after” difference in production when confronted with dumped Chinese products, the domestic AAM manufacturing market has yet to emerge.

“Due to China’s dominant market share, estimated at over 95%, the U.S. industry is in a position where it must match Chinese prices to have sales opportunities,” the petition said.

What are the arguments in the anode materials AD/CVD?

Some tariffs already apply to imported Chinese AAM, but these do not apply to AD/CVD. Under the sweeping Sec. 301 tariffs against Chinese goods, artificial graphite is currently excluded, but natural graphite was added to the tariff list in September 2024 and a 25% tariff on natural graphite will come into effect on January 1, 2026. Either way, AAMP calls for a deeper look at AAM used in the EV and ESS market.

Major Chinese AAM producers mentioned in the petition include BTR New Material and Gotion. Major US importers of these materials include BlueOval SK, Energizer, Ford, General Motors, LG, Panasonic, Samsung SDI, SK Battery and Tesla.

Tesla has been the most active to date in refuting AAMP’s claims. As a major battery producer in both the EV and ESS markets, the company is dependent on the highest purity AAM, currently matched only by Chinese manufacturers. Tesla said it has received samples from some AAMP members and hopes to use domestic products soon. The significant imports of Chinese AAM will not impact the lower purity levels of domestic materials, Tesla said.

Tesla Megapack. Credit: DSD Renewables

“The domestic industry is in a normal ramp-up phase as it learns and develops the capabilities to produce AAM to customer specifications,” said Dinesh Swamynathan, Tesla’s senior director for battery cell supply chain, in a recorded testimony. “Tesla, along with the US government and other cell manufacturers, is already working to establish a domestic AAM industry. That process could take years, and additional tasks would not speed up the process.”

Panasonic has made similar statements about its desire to work with domestic AAM manufacturers, but the industry is not yet established.

“Panasonic wants to source American supplies. The Inflation Reduction Act creates incentives to source American supply. Once U.S. manufacturers demonstrate that they can produce AAM to Panasonic standards, we will be happy to purchase from them,” said Preston Zhang, senior manager in the strategic materials engineering group at Panasonic Energy in North America, in a recorded testimony.

When the AD/CVD petition was first filed, analysts said of Roth Capital Partners said it could have “disruptive, far-reaching consequences” because of the request for tariffs on AAM individually and when used in finished batteries. Roth estimated that the anode represents 10 to 15% of the battery cost, or about $15/kWh for a DC block that costs $120/kWh. If a 900% rate were placed on the anode, Roth estimates that the additional cost could be approximately $135/kWh, which equates to a 125% cost increase for the battery to $255/kWh.

The sector is awaiting the ITC’s decision next month. The trade then has the final say on any tariff amounts.