Researchers have conducted a techno-economic analysis to investigate the feasibility of a 10 MW-80 MWh liquid air energy storage system in the Chinese electricity market. Their assessment found that a significant level of price volatility is currently a critical factor for the commercial maturity of this storage technology.

Researchers from China’s Sichuan Normal University have introduced a real options-based framework to evaluate investments in large-scale liquid air energy storage (LAES).

Their work builds on previous research, in which they presented a LAES system that stores electricity in the form of liquid air or nitrogen cryogenic temperatures. “In our new analysis, we took into account uncertain factors such as investment costs and electricity prices in China,” said the corresponding author of the study. Xiaoyuan Chentold pv magazine. “We also examined the impact of various incentives, including subsidies and preferential tax policies, on the LAES investment.”

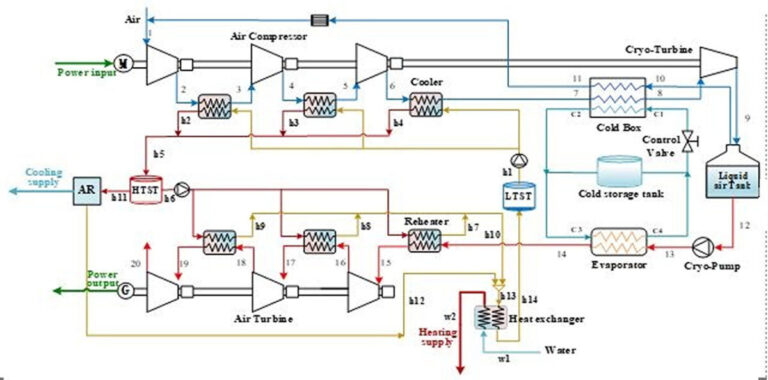

Their analysis was performed on a 10 MW-80 MWh LAES system that used a high-temperature thermal oil tank to store compression heat. During the energy storage process, the air is compressed by a three-stage compressor powered by electricity during off-peak hours. The high-pressure air is then cooled by intercoolers and further liquefied via a cold box and a low-temperature turbine expander.

The liquefied air is then depressurized to atmospheric pressure and stored in a liquid air tank. Within this process, the high-temperature air undergoes heat exchange with a heat exchange medium, and the resulting compressed heat is then captured by thermal oil and stored in a high-temperature heat storage tank (HTST) to facilitate air heating during the discharge process . .

During the energy release process, the liquid air is pressurized using a cryogenic pump, followed by evaporation in an evaporator. The high-pressure air produced is then further heated by hot oil from the HTST using a reheater. It is then expanded into a three-stage air turbine unit to generate electricity. The thermal oil used in the reheater is reserved and stored in the low temperature heat storage tank (LTST). The stored oil is used in the next charging cycle.

“In the multi-generation mode, the residual high-temperature thermal oil serves as a heat source for the absorption refrigerator (AR), allowing cold energy to be generated,” Chen explains. “After releasing some of the heat in the AR, the discharged thermal oil is mixed with the low-temperature thermal oil. After heat exchange via heat exchangers (HEXs), the mixed thermal oil is stored in the LTST. This process enables the delivery of hot water to the user side.”

The simulations and calculations of the system were performed using the Aspen HYSYS software. The energy consumption during the compression process is 18,168 MW. The output power of the air turbine is 10.02 MW. In addition, the multi-generation system can provide 3,942.44 kW of heating and 2,114.26 kW of cooling. The return efficiency for the system is 65.71%.

Image: Sichuan Normal University

“Our economic analysis showed that under the current conditions of China’s energy market, it is virtually impossible to trigger immediate investment in the multi-generation LAES system,” Chen said. “The recommended investment times are 2029 for Guangdong and 2031 for Jiangsu. For Beijing and Qinghai, the optimal investment time is 2036. At the optimal investment times, specific capital expenditures are estimated to range from $882/kW to 1,177/kW, while the levelized storage costs (LCOS) range from $0.105/kWh to $0.174/kWh. The optimal investment values are approximately $1,176/kW$ for Beijing, $926/kW for Guangdong and $882/kW for Qinghai.”

Regarding the impact of incentive policies, the results show that preferential tax policies can increase the investment value of the LAES system, especially in regions with larger differences in electricity prices in the off-peak periods. Increasing the investment subsidy and the learning effects of technology have a limited impact on stimulating investment. In contrast, the discharge subsidy policy can bring forward investments by at least one year and is preferable for promoting investments in LAES systems. “In Guangdong, investors are recommended to take immediate investment action once the discharge subsidy reaches $0.133/kWh,” Chen said.

The researchers said that ensuring an appropriate level of price volatility is a crucial factor in boosting LAES’ participation in the electricity market.

It is recommended to further improve time-of-use pricing mechanisms to create greater profit potential for LAES operations. Second, policymakers should prioritize the introduction of discharge subsidy policies due to the limited progress in the optimal investment time and improvement of the optimal investment value due to increasing investment subsidies and technology learning effects. Third, governments should actively strengthen markets for ancillary services to provide diversified benefits for LAES projects, as policies that focus on increasing revenues rather than just reducing investment costs are more effective in promoting investment in LAES.

The details of their analysis can be found in the study “A true options-based framework for multi-generation liquid air energy storage investment decisions under multiple uncertainties and policy incentives”, published in Energy.

LAES currently has a Technology Readiness Level (TRL) of 8. The TRL measures the maturity of technology components for a system and is based on a scale of one to nine, with nine representing mature technologies for full commercial deployment.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content