In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

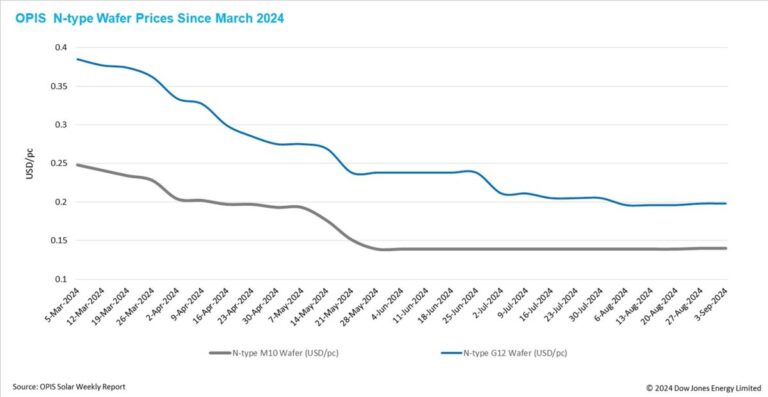

FOB prices in China for N-type M10 and G12 wafers have remained stable this week at $0.140/pc and $0.198/pc respectively, after a brief price increase last week driven by industry leaders.

Mobile companies, both in China and internationally, have so far shown limited acceptance of the recent wafer price increases. The two leading wafer manufacturers have managed to achieve a slight increase of approximately CNY 0.01-0.02 ($0.0014-o.oo28) per piece, depending on the customer. However, Tier 2 wafer manufacturers were unsuccessful in their attempts to implement similar price increases, although this situation also presents a significant opportunity for them to clear their inventories.

The sustainability of the waffle price increase is a topic of debate among market participants, who believe that in an oversupply environment it will depend mainly on changes in supply.

A Tier-1 wafer manufacturer is reportedly changing its business strategy following recent leadership changes. The company, which previously maintained a high production rate of over 90% for wafer production, has reduced this to around 70% since the last week of August.

Given the company’s substantial wafer production capacity, the plant’s decision to reduce production is expected to help restore the balance between supply and demand in the market over time and gradually return prices from loss-making levels to a more rational range . Nevertheless, the likelihood of a sustained price increase in the near term appears lower as the company’s new leadership has reportedly instructed its PV business to prioritize expanding sales and reducing inventories.

Another leading wafer manufacturer, which focuses on an integrated production model across the solar supply chain, has reportedly balanced production, sales and inventory levels in the wafer segment by diverting a large portion of its production to in-house production of modules. This positioning could allow the company to continue to push for wafer price increases, leveraging its integrated model to maintain cost advantages and potentially drive module sales as other manufacturers struggle with rising wafer costs.

Some industry voices are concerned that rising wafer prices could prompt small producers, who have reduced or halted production, to quickly raise their business rates. This recovery could potentially disrupt efforts to optimize production capacity and delay industrial integration in the wafer market.

Overall, market participants believe that the fundamentals of the wafer market remain largely unchanged, with overcapacity and high inventory levels still prevalent. A sustainable and substantial increase in waffle prices can only take place once overcapacity has been fully addressed.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content