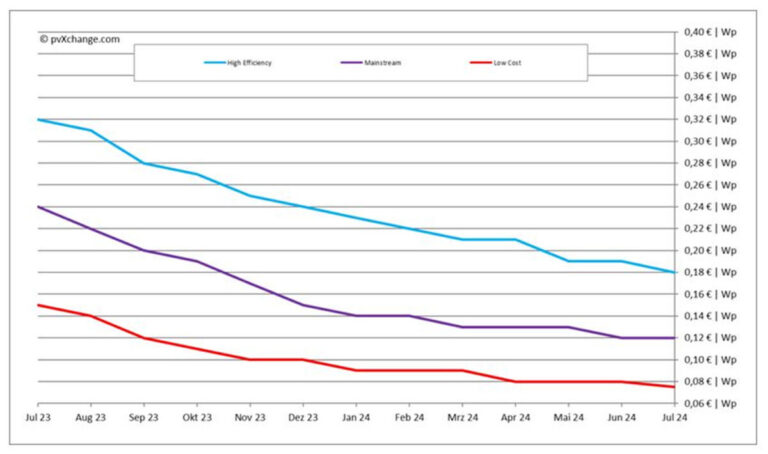

Martin Schachinger, the founder of pvXchange.com, explains how German solar installers are dealing with the current drop in PV module prices – now as low as €0.08 ($0.09)/kW. He says solar leasing could open up new opportunities, especially in the country’s commercial and industrial (C&I) sector.

Module prices have remained stable or slightly decreased this month, with no signs of change. Demand for both housing and C&I is lagging behind expectations and reaching a low not seen since the end of last year. Installers should prepare for a slow summer and consider new business models to keep their workforce engaged. Without short-term orders, they will have to explore alternative approaches.

Solar energy leasing offers significant opportunities, especially in combination with C&I systems. Wenzel Gerstner, co-founder of German startup Hellgrün, says the company secures roofs of commercial centers and creates energy solutions that allow companies to reduce their energy costs with photovoltaic electricity. It rents roof space from property owners and installs solar energy systems financed by private investors. Hellgrün takes care of the entire process, from administration and operation to energy distribution, while planning and technical management are managed by partners.

In order to sell the generated electricity profitably and above the current feed-in tariff, grid operators need long-term purchase contracts with tenants of commercial real estate. These agreements allow tenants to secure solar energy at a preferential rate, covering only their remaining energy needs from the grid. By coordinating generation and consumption profiles, self-consumption and profitability are significantly increased for both parties.

pv magazine

The June 2024 bumper edition of pv magazine examines the state of national power grids in key European markets as the region’s solar boom continues, considers the role small-scale PV arrays are playing in transforming the energy systems of Brazil and China, and studies the increasing importance of artificial intelligence and algorithms in generating electricity grid-related revenues from battery locations.

A model with partial feed-in and direct delivery to on-site tenants is preferable, but securing long-term contracts can be challenging due to high tenant turnover. Nevertheless, investor risk remains manageable as long as the German Renewable Energy Act (EEG) guarantees fixed rates, allowing full feed-in as a fallback option. Once a year there is the option to switch between partial and full return. In addition, the legislator recently increased the feed-in tariff for roof systems between 40 kW and 750 kW by € 0.0157/kWh, pending approval by the European Commission.

For a medium-sized PV installation of 100 kW, built with a considerable equity on a rental roof of € 100,000 to € 120,000, the return with full feed-in is around 5% to 6%. By opting for a lower-paid return of surpluses, the return can increase to 7% to 8%, assuming that there are no consumption shortages in the long term and that revenues remain above € 0.10/kWh. The electricity model for commercial tenants is approximately 30% more profitable than full feed-in under current conditions.

The leasing concept is not very profitable, but opens up a new market segment and allows installers to offer commercial customers options such as direct purchase or leasing with external financing. This approach helps customers avoid upfront costs and operational risks while securing orders for installers, even during difficult market conditions.

Image: pvXchange.com

About the author: Martin Schachinger studied electrical engineering and has been active in the field of photovoltaics and renewable energy for almost 30 years. In 2004, he founded the online trading platform pvXchange.com. The company has standard components in stock for new installations and solar panels and inverters that are no longer produced.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content