The atmosphere was optimistic at the recent Intersolar Europe trade show and Smarter E Europe event in Munich, Germany, despite high hotel prices due to the ongoing UEFA football championship. Most rooms were well attended. Exhibitors seemed pleased with the show, but football was ubiquitous and matches were played on monitors at every stand. Events were also planned around the match between Germany and Hungary.

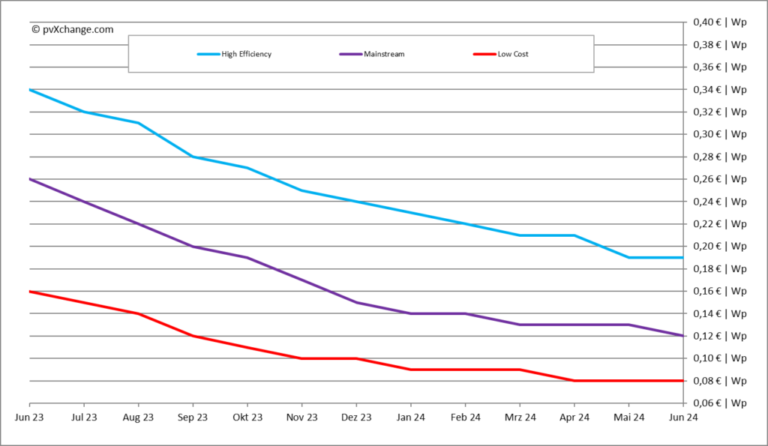

However, beneath the positive mood lie significant challenges for the PV industry. Demand has not recovered this year – a reality reflected in Germany’s declining installation figures. Module prices, especially for passivated emitter and rear cell (PERC) and tunnel oxide passivated contact (TOPCon) technologies, have fallen slightly, indicating a persistent supply-demand imbalance.

Despite efforts, there is an oversupply of modules flooding the European market, including advanced designs. Analysts attribute this to the fact that Chinese products are facing pricing challenges in some markets, while Asian markets are struggling with low sales prices, with the aim of eliminating excess inventory. Many major manufacturers are likely to scale back their expansion, while smaller players are expected to exit the market soon.

The inverter and storage systems markets face similar challenges, with a wave of Asian manufacturers dominating the sector at The Smarter E. Commercial and industrial (C&I) solutions were prominent, highlighting the potential to meet energy needs with tailor-made storage solutions. Manufacturers provide extensive support, including seminars and promotional campaigns, to drive market acceptance.

The outlook remains positive, with market growth expected in the second half of the year, supported by supportive policies such as the “Solarpacket 1” measures in Germany.