In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

Market activity in China’s mobile market calmed down as most market participants stood on the sidelines, unsure whether prices had bottomed out. Demand remained tepid as most market participants showed no urgency to replenish cargoes.

The majority of cell makers are facing cash flow problems and even though wafer prices have hit all-time lows, these cash-strapped cell makers have been unable to take advantage of lower wafer prices to build up their wafer inventories, a market veteran said.

Integrated manufacturers who had previously produced their own solar cells were now more inclined to buy cells from the market as buying cells was cheaper compared to in-house production, the source added.

Some cell manufacturers have turned to OEM production to maintain operating speed despite production losses. The fee for OEM cell production of M10 TOPCon cells had dropped to CNY 1.4 ($0.19)/pc, which is lower than the production cost of CNY 1.6/pc, a market veteran said.

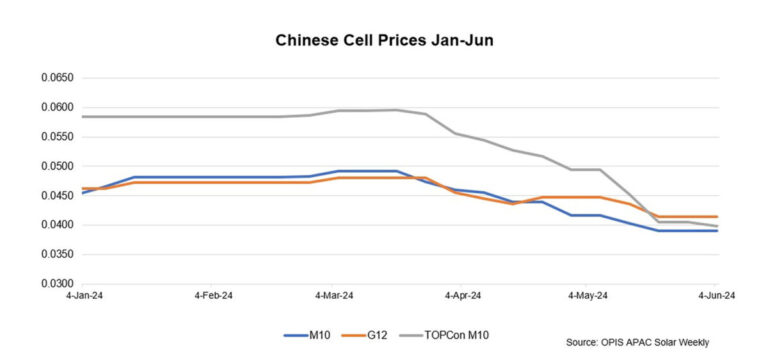

OPIS assessed FOB China Mono PERC M10 prices stable at $0.0390/W, FOB China Mono PERC G12 prices unchanged at $0.0414/W, while FOB China Mono PERC M10 prices increased by 1 week on week .73% lower were assessed at $0.0398/W.

High inventories are expected to put further downward pressure on cell prices in the coming weeks, even as cell manufacturers reduce operating rates in an effort to restore the balance between supply and demand. In addition, module manufacturers are expected to further reduce their business rates in June, which would result in lower cell demand.

According to the Silicon Industry of China Nonferrous Metals Industry Association, China’s cell production reached 62 GW in May.

In the Chinese domestic market, Mono PERC M10 cells cost about CNY 0.313/W, while TOPCon M10 cells cost about CNY 0.320/W according to OPIS market research.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.