A new report on the US solar and storage market shows improving returns on solar and storage investments, supported by falling hardware prices and rising energy rates – even amid California’s transition to NEM 3.0.

Enter solar energy has been published 2023 U.S. Solar and Storage Market Intelligence Report, which provides an overview of the solar energy landscape in the United States. Enact customers now see a shorter payback period, approximately 5.5 years, compared to approximately 7.6 years under NEM 2.0.

This comprehensive report provides invaluable insights into the trends, challenges and developments shaping the US solar and storage market, and underlines the critical role of Enact’s innovative platform in the clean energy transition. The 2023 report shows that as of December 31, 2023, the Enact platform has proposed more than $996 million worth of projects in the U.S. and more than $12.8 billion globally. The platform has monitored more than 110 MW of systems.

“The 2023 report indicates that the U.S. residential consumer’s transition to solar and storage has become increasingly complex, with a growing number of brand choices, complex NEM rates and widely varying service levels for installers,” said Deep Chakraborty, CEO of Enact. “However, as energy consumption increases and solar/storage hardware prices decrease, consumer ROI is steadily improving.”

The report highlights that between 2022 and 2023, there will be a notable increase in the number of energy storage options, with a more than 100% increase in the number of brands presented on the Enact platform. This increase in options creates greater complexity for both consumers and installers, highlighting the need for trusted sources in the industry.

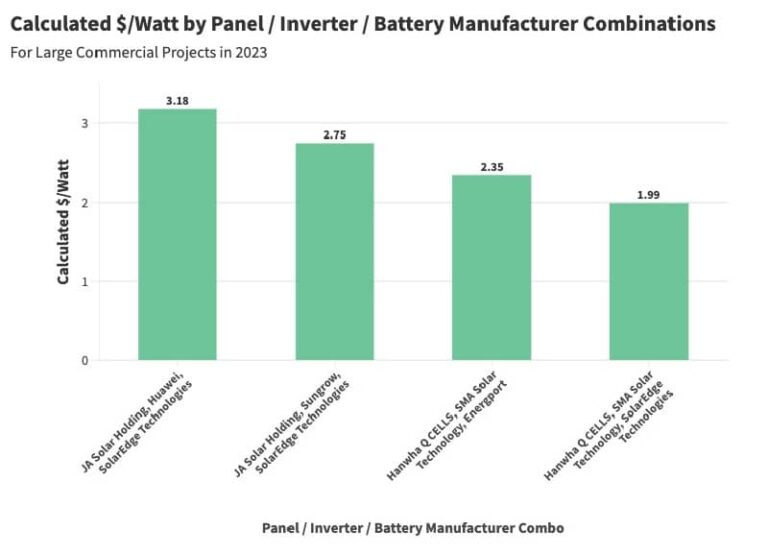

The Enact report underlines the escalating price differences between brands, including in the sale of homes with storage in combination with solar energy. The average price for solar plus storage systems was around $3.60/Watt and the peak price was around $5.85/W for residential projects. There was a wide range of residential prices for solar-only systems, with an average price of $3.33/W and a peak price of $5.12/W.

The report compared average pre-project consumer energy consumption with customer electricity bill values. Enact noted a 5% increase in average bill and 37.72% higher pre-solar consumption for customers looking for solar and/or storage options in 2023, compared to 2022. The rising consumption – along with rising energy costs and climate change – has increased demand for solar energy solutions.

The Enact Platform evaluation revealed a significant difference in service levels among installers, highlighting the critical need for reliable data and guidance in the selection process. As consumers navigate the complexities of transitioning to solar and storage solutions, Enact remains steadfast in its commitment to providing trusted advice and facilitating seamless experiences through its innovative platform.

For more information and access to the full report, please visit https://enact.solar/enact-2023-us-solar-and-storage-market-intelligence-report/.

Listen to more in-depth conversations on Solar Builder’s YouTube channel

Our most popular series include:

Power forward! | A collaboration with BayWa re to discuss industrial topics at a higher level.

The buzz | Where we give our 2 cents per kWh in the residential solar market.

The pitch | Discussions with solar manufacturers about their new technology and ideas.

Source link