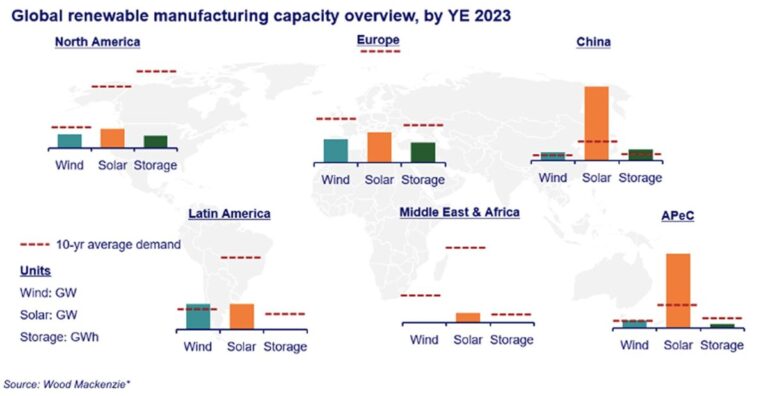

Wood Mackenzie says in its latest report that low prices and integrated supply chains will enable Chinese manufacturers to meet more than 65% of total global demand for renewable energy equipment, with exports expected to grow by 35% between 2019 and 2023.

Manufacturing costs for China-based renewable energy producers are up to 200% lower than Western players in key competitive markets, according to a new report from Wooden Mackenzie.

The consultancy said rapidly falling prices, alongside integrated supply chains and a “high performance standard”, have enabled China-based renewable energy producers to meet more than 65% of total global demand. It said there are indications that prices for non-Chinese products are double those of comparable Chinese-made equipment.

“Benefiting from a robust domestic supply chain, equipment produced by Chinese manufacturers abroad remains competitive in price despite an increase due to inflation uncertainty and higher production costs,” said Xiaoyang Li, APAC director of energy and renewables research at Wood Mackenzie .

The consultancy said Chinese manufacturers are targeting overseas markets with local content requirements to become regional manufacturing hubs. Between 2019 and 2023, China’s exports of renewable products grew by 35%, which Wood Mackenzie attributed to “competitive pricing and dominance of production capacity.”

During the same period, investments in wind and solar projects increased by 23%, while energy batteries surpassed solar panels to become China’s top renewable energy export.

According to the report, Chinese companies’ interest in investing in sustainable projects abroad is increasing, but progress is slow due to high development risks and uncertain revenue streams. Wood Mackenzie said Chinese renewable energy companies tend to invest in markets with high energy demand, a stable business environment and predictable revenue streams.

“Backed by strong supply chains for equipment from Chinese manufacturers, Chinese solar and storage investors prefer greenfield investments when looking for overseas opportunities,” Li said.

In November, Wood Mackenzie published a report saying that China’s massive increase in production capacity for solar panels and PV installations has allowed the country to maintain relatively low, stable energy prices compared to Europe and the United States.

China’s cumulative PV capacity surpassed 670 GW in April, thanks to about 60.5 GW of new solar installations since the start of the year.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.