In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

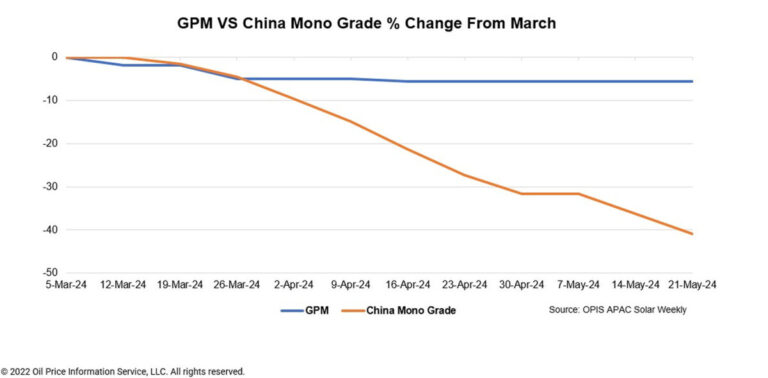

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was valued at $22.90/kg this week, unchanged from the previous week, reflecting stable market fundamentals.

Recent discussions have pointed to a possible slowdown in global polysilicon sales, attributed to shifts in international trade policy.

An upstream insider noted that the US’s reimposition of the Section 201 tariff on bifacial modules from four Southeast Asian countries in June will hamper exports of solar products from Southeast Asia to the US market. In addition, the US Department of Commerce (DOC) has initiated investigations into the import of solar cells and modules from these countries under anti-dumping and countervailing duties (AD/CVD), causing a slowdown in trade activities in the region. Consequently, this has led to a significant decline in the operational speed of production capacity in Southeast Asia.

“As a result, the sales pace of polysilicon made outside China, mainly destined for Southeast Asia, is expected to slow,” the source added.

A global developer source expects this situation to become even clearer in the second half of this year. “There will not be much demand for modules from the US in the second half of 2024 because the modules needed for installation in 2024 have already entered the US before the first quarter of 2024,” she added. It may take until 2025 for the sales situation of global polysilicon suppliers to rebound.

The source therefore predicts that global polysilicon supplies may build up some inventory in the second half of 2024, potentially leading to a price decline.

Another source with knowledge of the global polysilicon market has a contrasting view, claiming that global polysilicon prices are ultimately linked to end product prices. Despite recent reports of a rise in U.S. spot module prices to $0.4 per W, photovoltaic power generation remains the lowest levelized cost of electricity (LCOE) among available electricity sources in the U.S. So, there is still a possibility of further module price increases in the country, which in turn could help sustain the premium of global polysilicon prices.

China Mono Grade, OPIS’ assessment of polysilicon prices in the country was estimated at CNY36,167 ($5.09)/kg this week, down CNY2,833/kg, or 7.26% from the previous week. As the pace of polysilicon purchasing by wafer companies does not increase, polysilicon inventories continue to accumulate, putting further pressure on prices.

According to a China-based upstream source, the price of polysilicon used for n-type products from Tier-1 producers ranges between CNY40/kg and CNY43/kg, while that of Tier-2 and smaller producers ranges between CNY36/kg and CNY40. /kg. The price for granular fluidized bed reactor polysilicon (FBR), used in N-type products, has fallen below CNY35/kg.

“With the current price falling close to cash costs for all polysilicon manufacturers, polysilicon companies face an average loss of almost 40% at prevailing prices,” the source added.

Amid the continued surge in inventories, uncertainty looms as to when polysilicon will halt its price decline and stabilize within the sector, a market observer said. The observer further explained that reports indicate that polysilicon stockpiles are currently close to 400,000 tons, which is approximately equivalent to almost two months of production.

Numerous insiders reported that several polysilicon producers are undertaking production shutdowns or maintenance actions to navigate sluggish market conditions. According to an industry participant, most Tier-1 manufacturers have shut down their old production lines, while some second- and third-tier manufacturers with polysilicon production capacity in Ningxia Autonomous Region, Inner Mongolia and Shaanxi Province have also started maintenance. Therefore, polysilicon production is expected to decline month-on-month in May and June, although it remains uncertain whether this production reduction will be enough to reverse the downward trend in prices, the source said.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.