In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

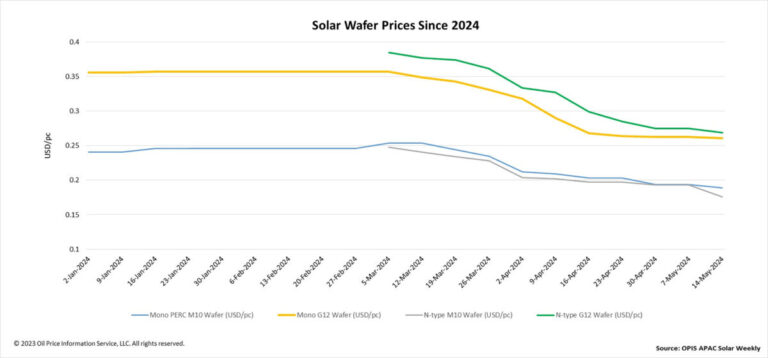

FOB Chinese waffle prices have seen another widespread decline this week, underscoring the prevailing oversupply and subdued demand in the market. Prices for mono PERC M10 and N-type M10 wafers fell by 2.58% and 8.81% week over week, to $0.189 per unit and $0.176/unit, respectively.

Similarly, prices for Mono PERC G12 and n-type G12 wafers fell 0.76% and 2.18% week-on-week to $0.261/pc and $0.269/pc, respectively.

According to OPIS market research, the average transaction prices of Mono PERC M10 and N-type M10 wafers in the Chinese domestic market have fallen to approximately CNY1.52 ($0.21)/pc and CNY1.41/pc, respectively. An industry insider even mentioned a transaction price of CNY1.35 for n-type M10 wafers, suggesting the possible direction of n-type wafer prices in the near future.

Wafer inventory remains high at around 4 billion units, equivalent to around 32 GW and half a month’s worth of production, an upstream source said. Against the backdrop of high wafer inventories, there have been reports this week that some manufacturers have even increased their business rates.

“The majority of wafer makers that have hiked their business rates are specialty factories that have secured OEM orders,” one source explained.

Within the entire wafer market, crucibles and other consumables for single-crystal growth furnaces, such as graphite heat zone parts and carbon-carbon composites, currently stand out as the only profitable segments, according to a market veteran. But even the prices of these components have fallen significantly, which is attributed to the reduced capacity of wafer manufacturers to bear the cost of consumables, the source said.

According to a market watcher, the business model of wafer manufacturers offers greater flexibility compared to polysilicon producers. They can adjust their business rates as necessary depending on their cash position, inventory status and commitment to the OEM business model. However, as the source added, significant changes in the supply and demand landscape could still require the inevitable closure and departure of certain wafer plants.

Several solar manufacturers recently released their first quarter 2024 financial reports, generating significant interest among industry insiders. According to one market watcher, this interest stems from a desire to understand the operational status of companies and to gauge factors such as the floor price of products or the survival prospects of companies.

Major wafer manufacturers, despite suffering a cash loss of CNY billion due to the expanded production capacity, can still maintain their competitive position because they have a production cost advantage, the source further noted.

Another market participant explained that it is challenging to predict when certain wafer manufacturers might go bankrupt to facilitate the improvement of supply and demand patterns. Factors such as cash flow status, financing capacity, and whether a wafer company has a background in state-owned enterprises contribute to the uncertainty surrounding the survival timeline of any wafer company in the market.

In the global marketplace, industry discussions have centered around the potential for an expansion of domestic module and cell manufacturing capacity in the US, which could boost the country’s demand for wafers from Southeast Asia. However, one market observer emphasized that significant demand for wafers in the US cannot emerge until cell manufacturing projects are established, a process that typically takes 18 to 24 months.

Furthermore, the source added that most of the wafer production capacity in Southeast Asia is currently owned by vertically integrated manufacturers who mainly use it for their own cell and module production within the region and rarely sell wafers externally. Consequently, the source expects the accelerated emergence of more wafer production capacity in Southeast Asia over the next two years, given the region’s status as a mature solar energy production market.

Recent press releases about production capacity also seem to support this observation. According to OPIS data from the past two months, there have been as many as five updates on wafer projects in Southeast Asia. This week it was announced that US-based SEG Solar has signed a land use agreement to establish its integrated PV manufacturing centre, including a 5GW wafer fab, in Indonesia.

Additionally, on April 30, Singapore-based G-Star announced the start of construction of its 3 GW billet/wafer plant in Indonesia. VSUN began production at its 4 GW wafer fab in Vietnam on April 18, while Astronergy began production at its 5 GW wafer fab in Thailand on April 15. In addition, Imperial Star announced on March 16 that the company is nearing the start of production at its factory. 4 GW wafer factory in Laos.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired assets with pricing data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.