In a new weekly update for pv magazineOPIS, a Dow Jones company, offers bite-sized analyzes of solar panel supply and price trends.

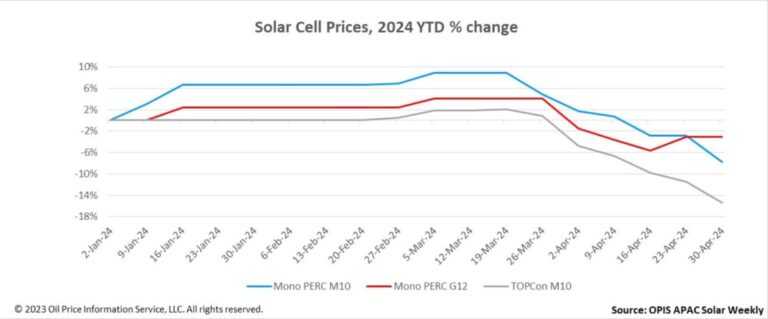

FOB China prices for both mono PERC M10 and TOPCon M10 cells continued to decline this week, estimated at $0.0417/W and $0.0494/W respectively, representing a decline of 5.01% and 4.45% compared to the week before.

FOB Chinese prices for mono PERC G12 have remained stable this week at $0.0448/W. This stability can be attributed to the recent start-up of several ground-mounted solar projects in China, which has increased demand for this cell type. The limited production capacity for these cells has led to an intermittent supply shortage.

In the Chinese domestic market, mono-PERC M10 cells were priced at approximately CNY0.335 ($0.046)/W, while TOPCon M10 cells were approximately CNY0.397/W, according to the OPIS market survey. According to a major TOPCon cell manufacturer, the current price development of cells closely reflects the price development of wafers.

Furthermore, this source stated that there is no evidence that there are demand factors driving a reversal in price trends, and that the only predictable solution to reverse the current sluggish market is to wait for some production capacity to be phased out.

Discussions are ongoing about module manufacturers planning to scale back production in May. This has raised concerns among some insiders about the potential accumulation of cell inventory. One prominent cell manufacturer therefore expects cell prices to continue to decline in May, with TOPCon cells likely to experience a more pronounced decline compared to mono-PERC cells as the latter’s production continues to shrink.

“The current scenario in the TOPCon cell market is proving to be quite challenging,” the source added, “with even Tier-1 cell manufacturers depending on accepting OEM orders to continue their operations.”

Another smaller cell manufacturer shares a similar sentiment, indicating that the price of mono-PERC cells could soon reach its lowest point due to the reduction in production capacity. Adding weight to this argument is a leading cell manufacturer’s intention to further reduce production capacity of mono-PERC cells in May, the source said. Conversely, this source expects that a new round of price cuts for TOPCon cells in May seems inevitable.

According to a market watcher, some cell manufacturers recently found that investing in building TOPCon cell capacity was less cost-effective due to the pessimistic price trend of this product. This source further explained that earlier this year, in order to reduce losses, a leading integrated manufacturer of nN-type products chose to collaborate with another lesser-known manufacturer to set up TOPCon cell production capacity. The aim is to strengthen the module production of this major n-type manufacturer.

This model, in which major players support smaller producers, share risks and engage in mutually beneficial collaboration, could potentially set the course for the future of business operations, the source added.

In terms of product dimensions, two prominent cell suppliers have confirmed with OPIS that they will begin mass production of n-type 210R (182mm x 210mm) cells in May or June. One of them noted that these 210R products are expected to make noticeable progress in the market in the second half of this year, which will be a crucial parameter for increasing the module’s power.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.