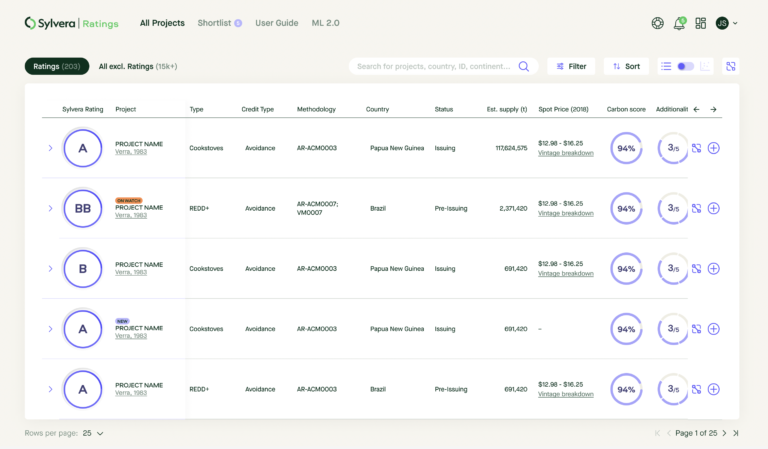

Carbon Data Company Sylvera has unveiled a new feature in its platform aimed at improving the ability to filter and compare carbon projects in a simplified and faster way.

Until now, project information and data have not only been fragmented but also difficult to analyze when assessing projects side-by-side, leading to a lack of transparency on key issues such as quality and credit availability. Investors interested in a full picture of a project have often had to work at a spreadsheet level that does not provide the full picture or is not standardized in a way that allows comparison with other projects.

“A major pain point in obtaining quality carbon credits is understanding what project types exist in the first place and what their existing offerings are. Sylvera’s project catalog answers these questions seamlessly and directly, allowing buyers to focus on the details of the project rather than the time-wasting aspects of aimless searching. It is now a crucial tool in our approach,” says Mark Goldman, Head of Carbon Science at Oneshot.earth.

These issues are solved by the two-pronged approach of Sylvera’s Project Catalog and Screening functionality. The catalog collects data from nine registries (with more to come) and covers almost 20,000 projects across the full spectrum of carbon markets.

At the time of launch, the registries are: Verra, Gold Standard, ACR, CAR, EcoRegistry, Puro, CDM, Emission Reduction Fund of Australia and BC Carbon Registry.

Screenings, the other part of the new feature, provides a detailed overview of key metrics that describe project quality and the risks they face. These are grouped around carbon accounting, additionality, sustainability and co-benefits.

Relevant: TEM partners with Sylvera to encourage due diligence in the field of carbon credits

Complementing Sylvera Ratings – used primarily for due diligence – screenings can provide signals about quality and risk challenges even before diving deeper into the due diligence process, essentially filtering out projects that do not serve individual goals that a company could achieve. has in terms of its carbon credit strategy.

This provides a fast track to shortlisting the most suitable projects for investment across eight project types: REDD (Reduction of Deforestation), ARR (Afforestation, Reforestation and Revegetation), IFM (Improved Forest Management), ICS (Inclusive Carbon Standard), RES ( renewable energy source), grasslands, croplands and methane in landfills.

In a statement following the launch of the feature, the company said it expects its customers to be empowered to make informed decisions about the projects they select for their carbon credit strategies. Sylvera also added that Project Catalog and Screenings can be seen as an important step in breaking through the complexity of carbon markets by providing a unique level of transparency and a due diligence tool that ensures trust.

Read more: Sylvera is the first Carbon Credit Rating Agency to apply the ICMA Code of Conduct