As the domestic solar manufacturing market becomes increasingly saturated with new companies setting up operations, solar brands are trying to find every competitive advantage they can. Most are banking on local incentives and tax breaks to equip their new factories, but there’s another option a few manufacturers are pursuing: operating within a foreign trade zone (FTZ).

What is an FTZ?

Clean Energy Associates shared exclusively with an excellent FTZ explainer World of solar energy that can be read here. In general, an FTZ is a specific geographical area where special customs procedures are used. A manufacturer within an FTZ can import goods for manufacture duty-free and not have to pay import duties if the finished product is subsequently exported from the United States. FTZs stimulate domestic production of goods and increase our country’s exports.

The Foreign-Trade Zones Board (FTZB), led by the Sec. of Commerce and the Ministry of Finance, approve zones, and zone operators activate businesses within the FTZ together with Customs and Border Protection. For example, the first FTZ in the country, designated in 1934, is New York City, which is operated by the New York City Economic Development Corp. (NYCEDC). NYCEDC has approved and activated sites such as JFK International Airport and FedEx to operate within the New York FTZ. There are currently 261 FTZs in the United States, where hundreds of companies benefit from trade rules within their borders.

What do FTZs have to do with solar energy?

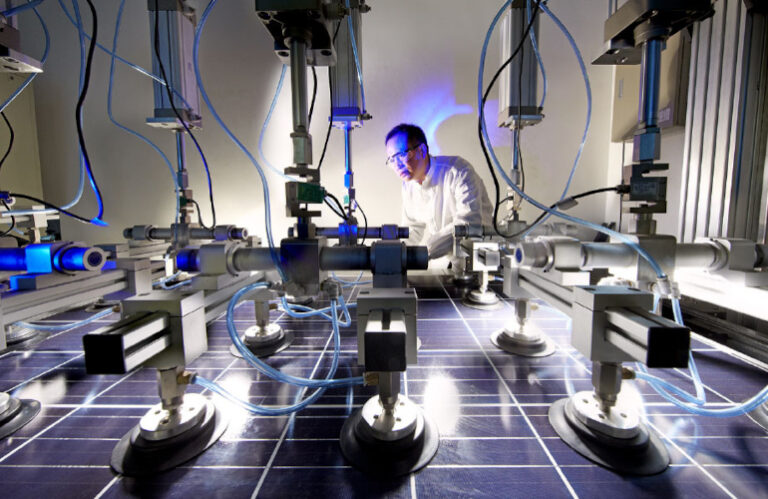

Credit: Trina Solar

More and more solar manufacturers are locating in the United States because domestic demand for solar products is so high (and the incentives in the Inflation Reduction Act are helping). Because the main requirement of an FTZ is that U.S.-made products must be exported, it seems counterintuitive for U.S. solar manufacturers to enter one of the zones. But there are other benefits available to companies operating in an FTZ when selling their products to Americans.

Companies that do not operate in a free zone must pay import duties on inventory once it reaches shore. If a business is in an FTZ, its inventory is tax-free until it is ready to be sold. If the company were producing for the domestic market, the company would pay the import duties with the profits from sales before the goods were manufactured. This would initially allow manufacturers to invest more money in their operations.

As a very specific example, a solar panel manufacturer in an FTZ could import solar cells without tariffs, assemble the panels with US workers, and then export those panels to India without paying any tariffs on the cells. The company could instead sell those panels to the U.S. market and pay the tariffs for the cells at the point of sale. Working in an FTZ does not mean that a company is excluded from paying duties; it only delays that payment when selling products in the United States.

There are other tax benefits associated with working within an FTZ. Some states, such as Arizona, determine property taxes based on your geographic zone. Companies that work within an FTZ often have the lowest property tax. Reduced property taxes can also support a manufacturer’s operations.

Which solar companies are in FTZs?

Approved and/or activated locations within the 261 FTZs are listed by the International Trade Administration. There are a few companies involved in solar energy production and storage that have approved sites, but none are currently operating.

JA Solar is building a 2 GW solar panel assembly plant in Phoenix. Although not yet operational, JA Solar has already done so approval to work within the Phoenix FTZ. Similarly, under construction has been battery manufacturer KORE Power approved in the Maricopa FTZ in Arizona, but it is not yet active. REC Silicon is also inactivated approval within the Moses Lake FTZ, and Wacker Polysilicon has been inactivated approval within the Chattanooga FTZ. Wacker’s chemical division is active in the Detroit FTZ, but not the polysilicon operations.

Trina Solar is trying to get its under-construction 5-GW solar panel assembly plant approved as an FTZ site in Dallas. The Dallas/Fort Worth Airport FTZ is currently Review Trina’s application. Trina stated that it would import foreign components such as aluminum frames, EVA, junction boxes, solar cells and glass, and that many of those products would fall under Sec. 201, sec. 301 and AD/CVD orders. The FTZ board will accept comments on the matter until the end of April 2024.

Trina stated in her documents that she plans to sell her completed solar panels in the US market. Operating within the FTZ would ensure faster customs clearance and lower customs costs. “Such benefits provide load stability and help ensure Trina Solar’s long-term viability at this location,” the company said.