In a new weekly update for pv magazineOPIS, a Dow Jones company, offers bite-sized analyzes of solar panel supply and price trends.

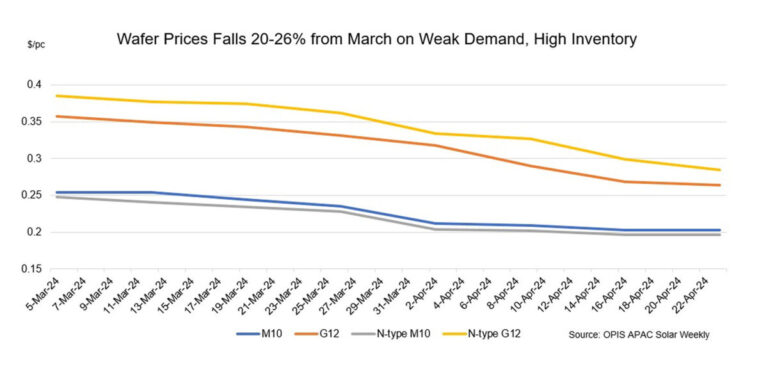

FOB China prices for both mono PERC and n-type M10 wafers have temporarily stabilized after five consecutive weeks of declines, estimated at $0.203 per unit (pc) and $0.197/pc, respectively.

Meanwhile, prices of mono-PERC and n-type G12 wafers saw further declines, down 1.49% and 4.68% week-on-week, respectively, reaching $0.264/pc and $0.285/pc.

According to a market source, the continued decline in the price of G12 wafers can be attributed to reports indicating that a major manufacturer of G12 wafers has the largest inventory among producers in the industry.

According to OPIS market research, the average transaction prices of mono PERC M10 and n-type M10 wafers in the Chinese domestic market remain around CNY 1.625 ($0.22)/W and CNY 1.583/, respectively. Despite wafer companies facing financial losses for about three months, recent significant declines in polysilicon prices have helped ease their losses, as reported by an upstream source.

The wafer companies are currently facing losses ranging from CNY0.1/pc to CNY0.15/pc on average based on current polysilicon and wafer prices, the source said.

Efforts to reduce production and clear wafer inventory are progressing slowly, according to a market observer. The current wafer inventory still fluctuates between 3 and 4 billion units, roughly equivalent to about 28 GW. This is a production value of almost two weeks, as the Silicon Industry of China Nonferrous Metals Industry Association expects wafer production of 63 GW in April.

The current downturn may only lead to a breakthrough if some companies exit the market because they are unable to sustain the current loss situation with their cash flow, according to a market participant.

A downstream source has expressed interest in several wafer companies’ first-quarter financial reports, which are expected to be released soon. Reports are circulating that one waffle maker suffered a loss of 3 billion yuan in the first quarter, the source said, although this has not yet been confirmed. However, clarity on this issue is expected once the financial reports are made public.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.