In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

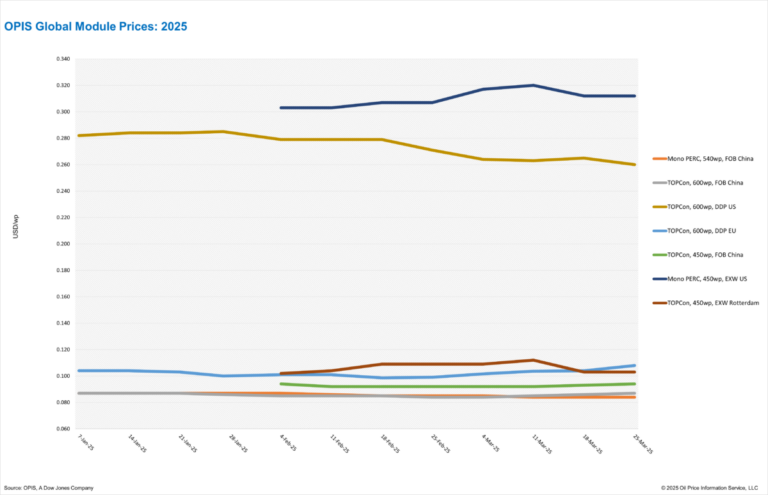

China: The Chinese Modulemarker (CMM), the OPIS-Benchmark assessment for Topcon modules from China rose 1.14% to $ 0.089/W free on Board (FOB) China, with higher price indications between $ 0.085-0.093/W. FOB China Mono Perc module prices remained stable at $ 0.085/W FOB China with indications between $ 0.082-0.088/w.

The Topcon module prices of China have expanded the profit for the fifth consecutive week, powered by a strong domestic demand prior to an expected Q2 installation. According to sources of industrial sources, a FOB charging agreement of 200 MW April for Top Conconconton modules was performed at $ 0.090/W. In recent weeks, various transactions have been heard between high-$ 0.080 to low $ 0.090/W FOB China.

In the forward curve, price increases were mainly seen in the previous months due to a ray of effect on higher spot prices. Although sources from the industry expect that prices will relieve after April, various manufacturers have held their offer levels until June.

Q2 2025 Loads rose 1.14% to $ 0.089/W, while Q3 2025 prices with 1.16% to $ 0.087/W were. Prices for Q4 2025 and Q1 2026 kept stable at $ 0.086/W and $ 0.085/W respectively. Q2 2026 The charging prices remained unchanged at $ 0.085/W, with offers ranging from $ 0.080-0.090/W.

According to OPIS data, ≥600 W Topcon modules since the beginning of February with 5.9% compared by 2.2% seen for 450 W Topcon modules for the same period.

Europe: DDP Europe Topcon prices for modules ≥600 W rose by 1% during the week. OPIS rated the average price at € 0.101/W for Tier 1 panels. This is the third consecutive week of price increase for DDP EU Topcon modules.

EXW Europe Topcon prices for modules ≤450 W remained stable and were reported at the average price of € 0.103/W.

Made in Europe Topcon modules were reported at an estimated price between € 0.250/W and € 0.300/W.

A large developer shared that he sees a high degree of activities for new solar projects in Eastern Europe, because the region is on its way to the cumulative capacity almost fourfold by 2033.

A Dutch manufacturer told OPIs that their plans to build a 1 GW PV module factory in the Netherlands is on hold due to market uncertainties, unclear rules and the long process for the European Netzero Industry Act to start.

US: The bargain price for Topcon ≥600 W DDP US was assessed this week at $ 0.260/W, a decrease of 1.89% week -on week, because customers continue to notice the availability of cheaper modules of suppliers in Laos and Indonesia between $ 0.21 and $ 0.24/W.

The bargain price for mono perc modules ≤450W EXW was stable at $ 0.312/w.

In the forward market, Opis Topcon modules rated in the first quarter of 2026 at $ 0.276/W, and Mono Perc modules in the same period at $ 0.266/W.

While new aluminum and steel rates are taking effect, a developer established in Canada said that she has seen the spot price of topcon modules from Southeast Asia to the US, rising around $ 0.01/w, from an average of $ 0.23 to $ 0.24/W.

While American assemblers continue to come online, the same source said that they see offers for modules assembled by the US everywhere “, from the high 0.20s/W to the high 0.30s/W, and said that the prices currently” largely randomly “seem to be” largely random, without a clear trend for prices from the supplier.

New import data provided by petitioners in the current AD/CVD case last week shows that, assessed on value, the import of solar cells and modules from January 2024 to January 2025 grew by 214% from Laos and with 4,797.96% of Indonesia.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content