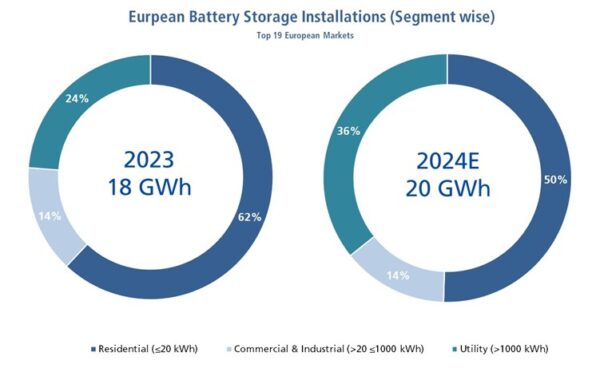

Europe’s photovoltaic (PV) and electrical energy storage (EES) markets undergo a fundamental transformation. Although small-scale PV and EES projects have driven the market growth historically, there is a clear and gradual shift to commercial and industrial (C&I) and projects on Nuts scale.

The shift of small-scale residential PV projects is powered by various macro-economic and policy factors. First and foremost, the pull-forward effect of the war in Ukraine. The conflict accelerated the demand as governments, companies and households hurried to protect energy independence in the midst of rising electricity prices and disturbed fossil fuel supplies. Emergency policy measures, accelerated permit and high economic stimuli have further condensed the expected growth in a short period. This in turn meant that fewer new customers were on the market in 2024, which led to a lower demand for premium brands that depend on first buyers. Moreover, with the decrease in module prices and the markets becoming more and more price-competing, many consumers opted for cheaper alternatives instead of premium systems.

According to EUPD Research’s 2024/2025 Germany PV & Ees Installermonitor© Report, based on a study carried out with 374 German installers, the fall in module prices also decreased the installation companies: 18% stated that they were adversely affected by the price decrease, while another 19% stated that they had both negative and positive effects.

Among companies that had a negative impact, almost 80% said it became more difficult to justify premium services or higher margins because of the expectations of the customer for continuously lower prices. This dynamic mainly influenced the installers who specialize in residential installations: among them the share increases to 83%, while it was slightly lower – 76% among installers who are also active in the commercial segment.

In addition, in a study, among more than 6,000 participants by EUPD Research’s Solarprosum monitor© 2024/2025 In Germany, 28% of PV owners stated that their PV system was installed in 2023 and 16% in 2024. With regard to storage, 36% of the participants, which purchased a residential storage system in 2023 and a smaller percentage in 2024.

What increased the pressure on the residential segment was that economic pressure, including higher inflation and interest rates, have reduced the purchasing power of average residential consumers (as seen in Sweden). De Kneep was felt more exclusively in the storage sector, where according to the aforementioned questionnaire Due to EUPD research, the most frequently mentioned reason for not (currently) interested in installing a storage system was the lack of (economic) profitability of a storage system, followed by high storage prices.

To relieve this burden, some governments have closed residential electricity rates. But not surprisingly manipulated by residential electricity rates, PV and storage investments made less attractive (such as in Poland and Hungary). In addition, the PV tree of 2023 (as mentioned above), combined with low module prices, encouraged certain governments to adjust their regulatory frameworks, as a result of which residential consumers lose confidence in their investments (as observed in Belgium and Sweden). In the meantime, the EU member states must achieve their PV goals in 2030, despite economic pressure and labor shortages, which are challenges for the labor-intensive and relatively expensive living segment. As a result, many countries, including the best European markets that are known for their dominant residential segments (eg Germany, Italy and France), give priority to projects on a larger scale, in particular in the commercial and industrial (C&I) and segments on a Nutschaal.

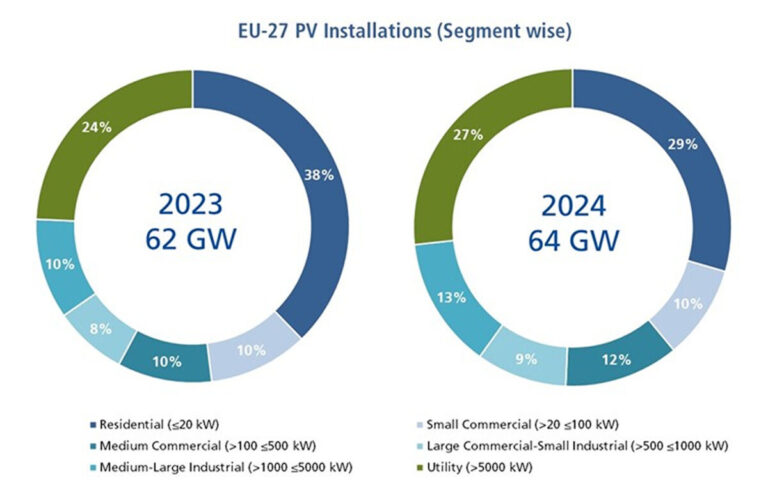

The overall impact of the above dynamics can be seen in the graphs below, where between 2023-2024 the share of C&I rose from 38% to 44% and the segment on utility scale from 24% to 27%. In the meantime, the share of the residential segment had a decrease of 9%.

Another impact was that the installers found out that they had to adjust their demand to systems with higher performance. If ours PV & Ees Installermonitor© Report shows that modules above 450 W are good for no less than 19% of the capacity installed in 2024 by installers who are active in the commercial segment compared to only 9% for installers of only residential. The proportions are almost perfectly reversed for modules under 350 W, which are good for only 9% of the capacity installed by C&I installers. The average share of storage systems of more than 20 kWh of total systems installed in 2024 is consistent 15% among commercial installers, more than twice as high as among purely residential installers – 7%.

As this segmental shift speeds, the scale of investments and the complexity of maintaining projects in the new segment -specific risk reduction strategies. Consequently, investors, developers, EPCs and the most important C & I and Utility scale customers must re-assess the criteria they use to select the most valuable and sustainable brands.

Against such a background, EUPD research has evidence that the long-term value and sustainability of a brand on the European market will be determined by:

- Financial strength and resilience: In an increasingly competitive and volatile market, consumers must take care of their maintenance. They must ensure that the brand they choose will not ideally go bankrupt within the life of the product.

- Reputation and consumer confidence: The best advertisement for a brand is what the installer and the prosumers think of it. All brands are on one and number one, but the real tier are those who have already won the hearts and spirits of the installers and prosumers.

- Innovation and market adjustment capacity: As the European markets grow up, the competition becomes. Those brands with the highest innovation will be the most resilient.

- And ESG Performance & Compliance: Apart from the European ESG mandates, consumers must always ensure that the brand they choose is in accordance with the European sustainability criteria.

Image: EUPD research

With this transformation, the risks are associated with selecting PV and storage brands intensified. Manufacturers operate on a very competitive market, where price pressure and volatility of the supply chain can lead to financial need, if not direct bankruptcy. EUPD acknowledges that only a low price strategy is not sustainable not only for the sun sector as a whole, but also for suppliers. Major brands are confronted with financial losses, while smaller players risk bankruptcy, creating an unstable market. In a market of quasi-homogeneous goods, a price-driven approach seems logical but it is not a strategy! It is just the blind that leads the blind and drives the industry to untenable margins and instability. Real market leadership requires differentiation, innovation and data -driven decision -making.

Investors and project developers must therefore go beyond traditional statistics and use a more holistic approach in evaluating potential suppliers. To guarantee a win-win scenario for all stakeholders (manufacturers, intermediaries and consumers), EUPD offers the solution: pure, high-quality primary data from manufacturers, intermediaries and customers, combined with precise secondary data.

EUPD Research Brand Leadership & Sustainability Rating: a risk -avoiding approach

To help stakeholders with this critical selection process, EUPD research has developed the “brand leadership and sustainability assessment – Europe”. This extensive assessment system is designed to offer a multidimensional assessment of PV brands based on four weighted parameters:

- European installation program, EPC and Prosumer Monitor – Evaluation of market perception, brand confidence and adoption trends with important stakeholders in the industry.

- Environment, Social and Government (ESG) and Innovation performance – Assessment of the ESG performance of manufacturers together with their dedication to R&D and technological progress.

- Price performance ratio -Analysis of the balance between prices and performance to guarantee high -quality cost -effective solutions.

- Financial health analysis – Measuring financial stability and insolvency risk to determine the life and market presence of a brand.

By integrating these parameters, the rating offers a well -rounded perspective that helps investors to reduce risks related to the insolvency of suppliers and fluctuating market dynamics.

Navigate with confidence through the future

For investors on C&I and Nuts scale, informed decision -making has never been so critical. The shift to larger solar projects requires more capital obligations and longer payback time, making it essential to collaborate with financially stable and progressive manufacturers. The Leadership & Sustainability brand offers a structured, data -driven approach for evaluating potential suppliers, whereby stakeholders limit risks and navigate the uncertainties of the market. By coordinating the interests of both manufacturers and investors, this rating must continue as a strategic security that that each investment is supported by reliability, resilience and long-term value. In a market where branding power can make or break an investment, this rating offers the clarity needed to reduce risks and maximize efficiency. By embracing a holistic approach to brand evaluation, stakeholders can change uncertainty in opportunities – so that the future of Europe on solar energy and storage is not only rosy, but also safe. That’s the way!

Authors: Mark AW Hoehner and Ali Arfa

Markus AW Hoehner is the founder, president and chief Executive Officer van Hoeper Research & Consulting Group and EUPD Research. He has been active in research and advice at the highest level for more than three decades, aimed at Cleantech, renewable energy and sustainable management. He can be reached at m.hoehner@eupd-research.com.

Ali Arfa is a senior data manager at EUPD Research. He graduated from the University of Bonn and with a background in European and North American politics. His expertise includes market research, policy development and analysis of stakeholders. His specific focus is on solar energy, energy storage and strategic consultation. He can be reached at a.arfa@eupd-research.com.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content