In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

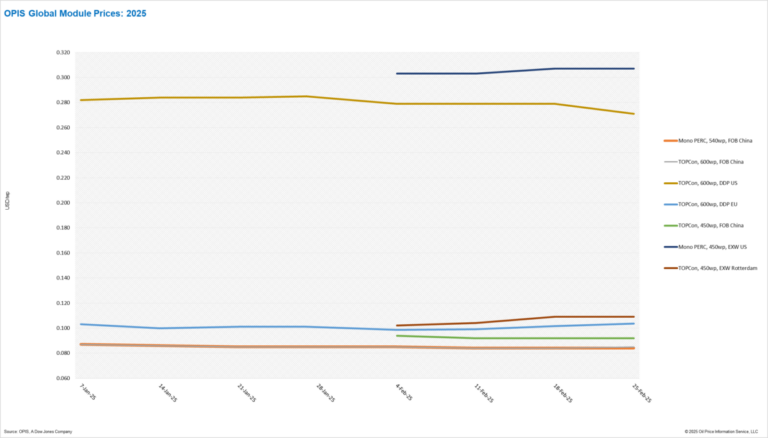

China: The Chinese Modulemarker (CMM), the Opis Benchmark Assessment for Topcon 600 W modules from China, Reden 1.19% to $ 0.085/W free on board (FOB) China, with price indications ranging from $ 0.082/W to $ 0.090/W. In the meantime, FOB China Mono Perc -module prices remained unchanged at $ 0.084/W, with prices ranging from $ 0.081 to $ 0.088/W.

FOB China Topcon 450 W modules for spot load were rated stably at $ 0.092/W, with price indications between $ 0.086/W and $ 0.100/W.

In the past week, transactions have reflected the price increases that were announced by manufacturers before the New Year’s holiday of Lunar, with prices that climb in the high-$ 0.080s/w, restoring compared to the all times of $ 0.084/W last week. Trade sources attribute this in part to a seasonal silence in module production since January, with the business percentages reportedly about 40%, and partly to an installation in Chinese projects due to a recent announcement in the rules of the power rate, leading to tightened module provision.

For loading the first half 2025, prices rose 1.19% to $ 0.085/W, with higher values between $ 0.082 and $ 0.090/W, while charging prices for the second half of 2025 remained stable at $ 0.085/W. In the meantime, the prices of the first quarter of 2026 increased 3.61% to $ 0.086/W, with higher price members ranging from $ 0.083 to $ 0.090/W.

Market expectations about future price trends of modules remain divided. Some sources expect a continuous price increase until the second half from 2025 to the beginning of 2026, driven by power -growing food reductions and weak modulemarges. Others, however, predict a fall in price after the deadline of 31 May under the aforementioned Chinese policy for the rate of China, as announced by the National Development and Reform Commission (NDRC). According to this policy, new solar projects that have been connected to the network will take on the market from 1 June on the market, which may lead to a sudden decrease in demand for domestic module and lower prices in the second half of 2025.

Europe: DDP Europe Topcon 600 W-module prices rose 2.06% week on week to € 0.099 ($ 0.102)/W, with price indications ranging from € 0.095/W to € 0.108/W for Tier-1 panels.

In the meantime, EXW Rotterdam (Western Europe) Topcon 450W module prices remained stable with an average of € 0.104/W, with price indications between € 0.095/W and € 0.110/W for Tier-1 panels.

According to insiders from the industry, the rise in module prices has been driven by real market support from mid -February. After the announcement of China of radical changes in his power rate structure, market players hurried for the end of April to deliver modules for domestic projects. As a result, projects that are initially planned for the second half of 2025 are planned in the first quarter of 2025, creating a observed module deficiency in China. This has a limited availability of export and offers support for the prices of DDP Europe.

The expectations of further price increases from March have also emerged in the Centrale and Eastern European (CEE) markets, with sources that anticipate that DDP Topcon prices can be the new normal in Cee in Cee.

United States: The spot price for Topcon 600 W module DDP US is this week with 2.87% a decrease of $ 0.271/W, while the spot price for Mono Perc 450 W modules Exw is stable for $ 0.307/W. On a future-oriented basis, OPIS assesses the costs of Topcon modules in the first quarter of 2026 at $ 0.282/W, and Mono Perc modules in the same period at $ 0.272/W.

While Laos and Indonesian manufacturers continue to offer the lowest priced options for American buyers, with quotes in the range of low to middle $ 0.20s/W, insiders warn that new trade studies will probably take as soon as import data offer sufficient justification.

Reportedly, large stocks are still in some American warehouses, which indicates that many importers were purchased in many modules prior to the new AD/CVD rates with the assumption that they could sell them later as soon as prices for new shipments rose dramatically. However, since this expected price increase still has to be issued, some sellers now want to discharge surplus shares, with one distributor emphasizing the availability of 545-550 W Mono Perc modules at $ 0.19/W.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content