February 24, 2025

The American community-zonne market installed a record-breaking 1.7 GWDC capacity in 2024, an increase of 35% compared to 2023, according to a new report. Published by Wood Mackenzie in collaboration with the Coalition for Community Solar Access (CCSA), the report also indicates how long -term growth in the balance is in the midst of policy uncertainty at both national and national level.

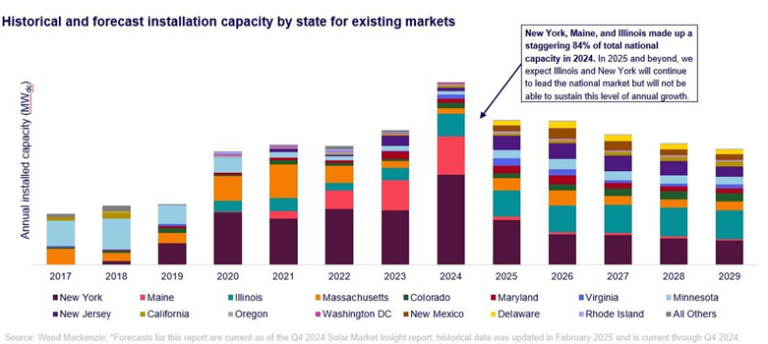

According to the report, last year’s growth was led by New York, Maine and Illinois. All three States break annual archives and accounted for 83% of the national volumes. Cumulative Community -Zonne installations now a total of 8.6 GWDC.

“We saw an impressive activity in 2024, which resulted in our strongest year so far for community growth,” said Caitlin Connelly, research analyst and main author of the report. “Despite impressive 2024 installation volumes, however, the top state markets are quickly saturated and will not be able to maintain the same levels of growth in the long term. In addition, emerging markets are slow to rise and limit the program size caps the potential for growth in these states to compensate for falls in larger markets. ”

As a result, national community growth in the basic case of Wood Mackenzie will increase 8% annually on average until 2029 annually, with more than 15 GWDC cumulative community zones installed. Depending on how the policy changes and reforming the interconnection develops, the growth views could, however, vary greatly.

“Although the new American administration has fueled an extreme amount of uncertainty in the American solar sector, material actions have so far resulted in minimal changes to our basi case outlook,” said Connelly. “In a low case that represents an extremely downward scenario, our five -year prospects, however, contract 40% compared to the basicase. On the other hand, the matters such as usual at the federal level and the rapid improvement of state policy and interconnection -conditions in a high case outlook 37% higher than the basic case. ”

Potential new state markets

A boost area can come from new state markets that have proposed legislation for community programs for the community. In the past year, the legislation in Pennsylvania, Ohio, Missouri, Iowa, Georgia, Washington and Wisconsin has progressed beyond ever, indicating strong two -part support and the potential for new market expansion. Community Solar is also included in important energy plans of the state, such as those of Pennsylvania Lightning Energy PlanStrengthening its value to legislators and supervisors. If everything comes by, new markets for solar energy -state markets in 2029 can stimulate at least 16% by at least 16%.

“Because opposition continues to exist in setting up new legally allocated Community solar programs, developers develop their business models and investigate new ways for the development of the community,” Said Connelly “These means are well positioned to play a crucial role When supporting gridper and increased electricity question, as they can be used quickly, can be scaled up and built with storage in the vicinity of the customer tax.

LMI customers can expand

Community solar capacity that serve directly with a low to moderate income (LMI) subscribers is concentrated in New York and Massachusetts. The two states combined include 49% of the 1 GWDC of LMI-serving Community-Sonne-Zonne energy, which emphasizes the constant dependence on state and federal stimuli to increase LMI capacity. In total, LMI subscribers make up 14% of the total community capacity used by the community.

Stricter LMI subscriber requirements in emerging state markets will result in LMI capacity that forms almost 18% of the total community capacity of the community in 2026. Federal uncertainty with regard to the LMI communities Adder and solar energy for all financing could possibly limit the long-term growth of LMI capacity.

Developer and assets -owner signs remain very consolidated

The top five of the community installers of the community secured 19% of the market in 2024, a decrease of 25% in 2023. The competitive landscape for power owners is considerably more exclusive, more dominant and region -specific than that of community installation agents in the community. The top 10 of the owners of solar energy cases ensured 54% of the capacity installed in 2024 and 40% of the cumulative capacity. Top owners include Nexamp, AES Clean Energy and Nautilus Solar.

“The record-breaking growth of Community Solar in 2024 is a clear sign that the demand for affordable, distributed energy is stronger than ever,” said Jeff Cramer, CCSA president and CEO. “This record growth comes at a time when the demand from the customer and the network to community zoning has never been higher. Barriers to meet this demand – such as interconnection tracing and policy trunk band, however, dozens of gigawatts on new local electricity, dozens of billions of dollars in investments and millions of customers on the sidelines. With the increasing Bipartisan Momentum to take on these challenges, the potential for continuous record growth remains strong. ”

Tags: Coalition for community access for community sun, community Solar, Wood Mackenzie