In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

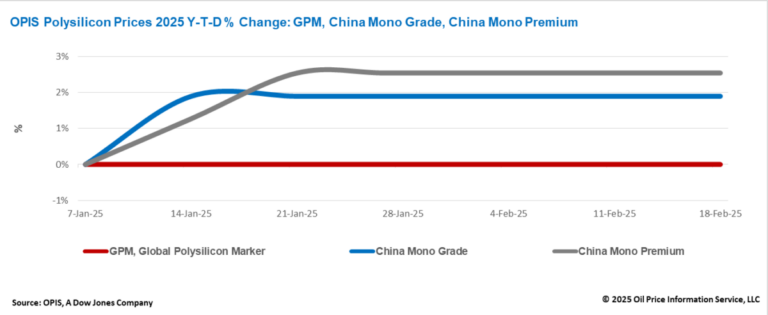

The Global Polysilicon Marker (GPM), the OPIS -Benchmark for Polysilicon produced outside of China, remained stable this week at $ 20,360/kg, or $ 0.046/W, as a result of unchanged market fundamentals.

The global polysilicon market continues to show stability, whereby suppliers mainly encourage long-term contract customers to adhere to payment schedules and to take monthly deliveries as agreed.

The relatively low American import tariffs of Malaysia have reportedly sustained some waffle and cell production. According to the China Silicon Industry Association, the Chinese Polysilicon export rose in December 2024 by 46% compared to November, with around 59% of shipments aimed at Malaysia. This indicates that although a certain production of wafers remains in Southeast Asia, a part can still rely on traceability-compatible polysilicon from China, so that the demand for polysilicon is bitten away.

Certain global polysilicon buyers are reportedly hesitant to extend long-term agreements when falsifying. These buyers keep a close eye on American trade policy developments, in particular potential requirements to separate photovoltaic import of Chinese components.

On 10 February, US President Donald Trump signed an executive order in which a rate of 25% was restored on the basis of section 232 over all steel and aluminum imports. Industry insiders indicate that this rate can be extended to the sun sector, with a potential study on behalf of the American polysilicon industry that can lead to high rates for products that contain Chinese Polysilicon.

If implemented, such measures can specifically limit the import of modules that contain a Chinese polysilicium in the American market, which can significantly increase global polysilicone prices and increase American module costs.

The China Mono Grade, the assessment of Opis for Polysilicon prices of mono-quality in the country, remained stable this week on CNY 33.625 ($ 4.63)/kg, equal to CNY 0.076/W. Likewise, the China Mono Premium, the price assessment of OPIS for mono-grade polysilicon used for the N-type Ingot production, stable on CNY 40.375/KG, or CNY 0.091/W.

The operational speed and the output of Chinese Polysilicon remain largely stable, with the average business speed about 40%. The production levels in February are expected to be comparable to those in January, at a level of just under 100,000 tons (MT).

In addition, the electricity prices in Sichuan and Yunnan – Key regions for large polys silicon plants – remain reported above CNY 0.50 per kWh, a level that is considered high for the production of polysilicon. As a result, it is unlikely that the company rates will rise in the short term.

The Polysilicon market of China is gradually heading for a more balanced dynamic for the supply of delivery. An established manufacturer of polysilicon with an annual production capacity of around 250,000 MT is reportedly stopped all production, while an integrated manufacturer with a total polysilicium capacity of 130,000 MT is said to be only a factory of 50,000 MT with a use of less than 20% .

Insiders from the industry agree that solving surplus capacity in the polysilone segment remains crucial for repairing the balance in the entire photovoltaic supply chain – a process that is now gradually disappointing.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content