In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

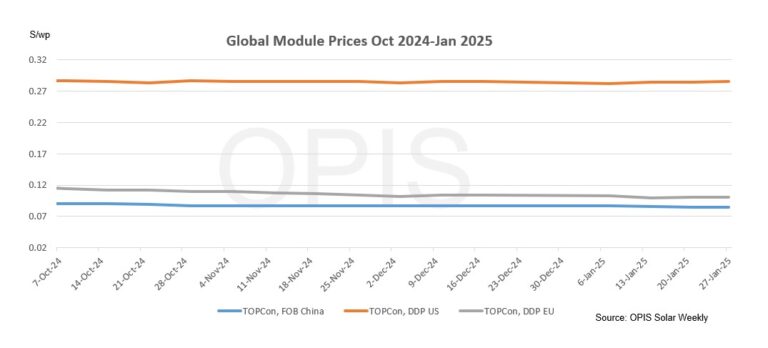

FOB China: The Chinese Modulemarker (CMM), the OPIS benchmark rating for Topcon modules from China was stable at $ 0.085/W free-on-board (FOB) China, with price indications between $ 0.080-0.090/w.

The question remains modest before the New Year’s holidays of the Moon. Despite recent increases in electricity costs, module prices remain stable, largely due to high electric stocks, which have absorbed a lot of the cost pressure.

A Tier 1 -producer expects prices to stabilize instead of increasing the short term, since high downstream supplies will continue to protect the market against electricity volatility. In the meantime, another producer noticed that the scenery prices seem to have “bottom outed”, which could offer “mild support” for module prices in the second half of 2025.

In capacity updates, different module factories have stopped production or reduced business percentages in January due to the festive season and poor market conditions. Producers hope to resume the business rates after the holiday stilt in mid-February.

Europe: Topcon modules Prices decreased by 2%every week, while overcapacity and shares the prices continue to keep low. OPIS assessed the average price at € 0.096/W, with indications between a low point of € 0.080/W and a high point of € 0.115/W for level 1 panels.

According to sources, the demand and production of solar PV in Eastern European countries such as Romania, Serbia, Poland, Slovenia and Ukraine quickly require. The manufacturers are smaller companies with less capacity (in total around 500 MW), and “they are more flexible and deliver”.

Insiders noted that Eastern Europe has a less strict regulatory environment for building production facilities, and that is why they can build faster than other European countries. They implement quickly and they will be ready for the Western European question, says sources.

US: The spot price for Topcon Utility-Scale Modules DDP US Rose this week 0.35% to $ 0.285/W. On a future-oriented basis, OPIS assesses the costs of Topcon modules at $ 0.293/W in the second quarter of 2025, $ 0.291/W in the third quarter and $ 0.282/W at the end of the year and in 2026.

While renewable project tax credits survived the first week of Trump, the president signed a series of executive orders that indicate that the inflation reduction law is very on the table, with one focus on loans and subsidies in the account, although the most of the allocated funds were “Mandatory” for projects prior to his inauguration. Tax lawyers say that the language does not cover the ITC of 30%, and the approval of the congress will be needed to enable the tax stimuli or change their phaser-out schedule and adders, such as the domestic content bonus.

According to a source, prices for Utility scale Topcon-Con modules DDP US between $ 0.21/W to $ 0.23/W from Indonesia, in the middle of the 0.20s for India, in the middle to high 0.20s For American modules collected with imported cells, and between $ 0.24/W and $ 0.25/W for modules assembled into Vietnam with cells imported from countries in the region that are not subject to the current AD/CVD probe.

Join Opis Solar Market Experts on 6 February for a webinar that will investigate how trade policy worldwide disturbs the worldwide supply chain for solar energy. Most important topics that must be discussed during “Solar 2025: Bust-ups, break-ups and shake-ups“The diversification of polysilicon Supply Chain, the overseas strategies of Chinese manufacturers, the American PV production and trade policy and Europe’s PV production from Renaissance includes. Read more and register here.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content