After a challenging 2024, characterized by high inventory levels and a falling demand for residential requirements, the inverter market will restore in 2025. Worldwide inverters are expected to increase by 7% to reach 570 gigawatts, an alternating current (GWAC), with an increase in inverter shipments on the European market as stock levels that are slowly balanced, according to the latest prediction for the worldwide inverter market of S&P Global Commodity Insights, the leading independent supplier of information, data, analysis, benchmark prices and workflow solutions for the raw materials and energy transition markets. The competition will remain intense as more players enter the industry and encourage suppliers to innovate and update their portfolios. See Highlights of the S&P Global Commodity Insights -Prepisations below:

- Global market income of the inverter grow by 8% in 2025

After a challenging 2024, it is expected that the global inverter market will return to sales growth, with the total turnover that will achieve an estimated slightly less than $ 20 billion in 2025. An important engine of this revenue growth will be the restoration of the European residential market in 2025, which in 2025 is usually a profit center for manufacturers of Western and Chinese inverters, both. Turnover in Europe is expected to increase by 27% in 2025, driven by increased shipments to the residential segment, which suffered from consistently high inventory and reduced residential installations in 2024. However, European turnover in 2025 will remain lower than 2023 levels as a high level As a high level of competitive groups price reductions in the market. Elsewhere, turnover in the United States will increase by 16% in 2025 as the residential market recovers from a delay in demand and oversupply for inventory. However, this will be compensated by a turnover drop from 13% to China, because the installations are struggling to grow and high levels of competition lower the price and turnover in 2025.

Weak-grid markets are expected to be a growing source of income for manufacturers of inverters in 2025. Will be sustained by success in South Africa in 2023 and Pakistan in 2024, an increasing number of manufacturers is looking for emerging markets and releasing cost-competitive products to Local requirements. Expect fast-growing markets in 2025 to come up in regions such as in Africa, the Middle East and Southeast Asia, because manufacturers have tightened their products for weak grid markets in recent years.

- New suppliers contribute to overcapacity problems

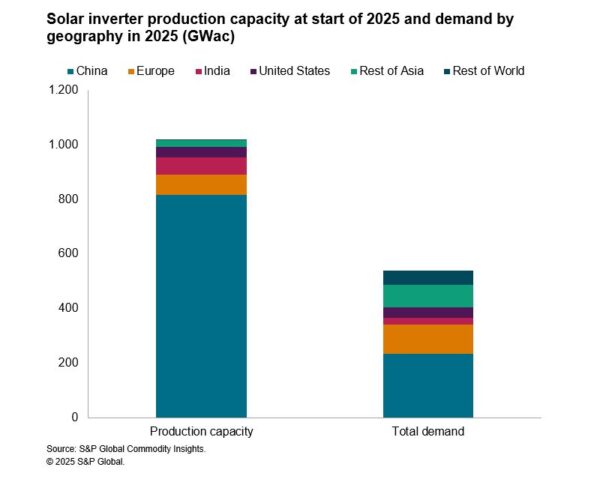

Manufacturers hurried to expand the capacity to 2022 and 2023, because semiconductor shortages and a flourishing demand for solar energy drove exuberance on the market. Newcomers, usually from China, flowed to the market that was lured by growing income and strong profit margins, while established players expanded their production base. Towards the end of 2023, however, the market had weakened from a limited to oversupply, stranded with various expansion plans. S&P Global Commodity Insights estimates that the production capacity of the global inverter 1 TW by the beginning of 2025 was far before the predictions for the question of 2025 at 538 GWAC.

Overcapacity problems are added by newcomers that arise from adjacent industries such as the white goods and the portable electronics industry. Newcomers and structural oversupply will force manufacturers to compete heavily on price and to continue to update their inverter portfolio. With the global solar installations that will grow with a CAGR (2024-27) of only 3.4% for the coming 3 years, according to S&P Global Commodity Insights, manufacturers can expect that heavy market conditions will continue in 2025, with gradual price drops and Press Reds and Press Reds and Press Reds and Press the gradual price drops and Press Reds and Press the gradual price drops and Press Reds and pressure expected ‘normal’ profit margins.

- Cyber Security -concerns will increase the pressure at manufacturers

Cyber security announcements and requirements in different countries and regions increased by 2024, with this trend expected to intensify in 2025. Last year Lithuania adopted legislation to give Chinese manufacturers access to circumstances at locations at locations at locations at locations at locations that have more than 100 kW more than 100 kW, the federal office for information security recently warned that the risk that foreign Getting power to gain control over parts of the country’s electricity system is growing. The growing requirements arise from the consequences of cyber security attacks. These can be important; Resulting in operational disruptions for consumers, a loss of trust in manufacturers, fines from grid operators and even black -outs on the basis, just like the infringement, affects a sufficiently sufficiently installed basis.

Continuous geopolitical tensions increase the risk that cyber security will burst on stage in 2025. Manufacturers are expected to check more from regulators in the coming 12 months, while the record levels of solar energy continue to connect to the electricity schedule, with the risk of barriers or even prohibited over certain foreign inverters due to rising national security problems. This can have a secondary advantage of helping local manufacturers to compete at their home market, given stiff global competition.

4. Advanced customer needs must stimulate product evolution and digitization in the segment behind the meter

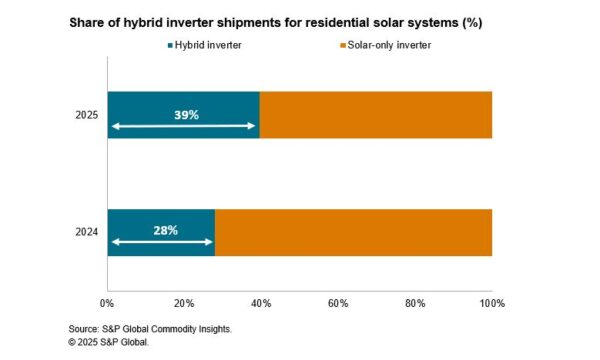

2025 will be a record year for hybrid inverters in terms of shipments. With the decrease in financial incentives for solar energy export to the grid and increasing the consciousness of self-consumption in important residential markets, including Europe, California and Australia, hybrid inverters, who combine the conversion of solar energy and energy storage, The standard for residential solar energy PV systems in many markets. In weak grid areas it will make it possible to continue to get hybrid inverters between off-grid and grid-bound modes with low voltage inverters between off-grid-connected modes. Moreover, more manufacturers are expected to release hybrid inverters with higher power reviews in 2025 to tackle commercial and industrial (C&I) scenarios.

Speed and InstallatieGemak are an important theme for the residential segment in 2025, especially in Europe. All efforts to relieve the installation time will reduce the labor and total installation costs and will probably help to increase installation volumes. Integrated solutions with batteries and power conversion systems (PCs) or as we call it at S&P Global Commodity Insights – ‘Energy Storage Inverter’ combined as a complete device simplifies the installation to less than 30 minutes and are expected to receive market share in 2025.

In 2025, with the introduction of dynamic rates in more markets and the mature of business models for virtual power plant (VPP), consumers will increasingly require their energy assets to respond to electricity rates to minimize accounts and participate in the energy market. Trading and grid service provession for extra income. The manufacturers of inverters are expected to make more efforts in the software area to meet the needs of the customer and to remain competitive by improving their own software offering or by working together with third-party software providers. The use of AI, both to help consumer understanding and to act as an optimization agent, will also be an important distinguishing factor for suppliers of inverter.

- Innovation takes place for products from front-of-the-meter to lower costs, increase efficiency and support grid stability

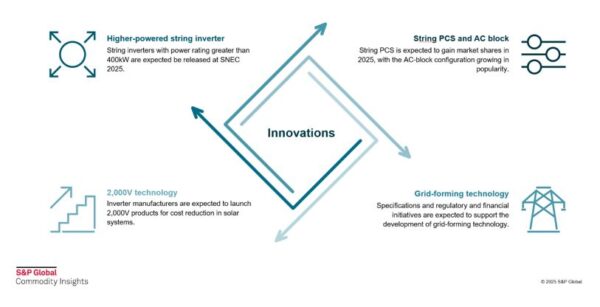

The manufacturers of inverters are expected to release new products in 2025 to further reduce costs. Stringom formers with power assessment larger than 400 kW will probably be released at large trade fairs in 2025. With higher power reviews, these string reasons offer a lower price per watt and save the balance of system expenses for solar files as a result of lower cabling, installation, installation and operation and maintenance costs (R&M) costs as a result of less used inverters.

The other technology to view in 2025 is 2,000 Volts (V). Pushing from 1500 V to 2,000 V makes it possible to make longer strings of modules, which leads to fewer strings for solar systems, which will help to reduce the electric balance of the system by 10% – 15%. The transition of 2,000 V in 2025 will focus on central inverters, because string -formers require extra cooling techniques and sub -components to continue to 2,000 V.

For energy storage, it is expected that the share of PCs in the before-with-with-applications will grow in 2025, because the control of the recking level that it offers will offer higher efficiency and lifelong lifespan, easier maintenance and increased uptime. AC-block configurations, which integrate battery racks and string PCs into one container, will continue to grow in popularity due to the easier installation and land saving functions.

In 2025, PCS manufacturers will continue to concentrate on roster-forming possibilities, which have become increasingly valuable for grid operators as renewable assets penetrate the grid. Additional specifications are expected to be released, together with legal and financial initiatives to strengthen the development of grid-forming technology.

S&P Global Commodity Insights provides extensive market data, benchmarks and insights for the worldwide market for energy and raw materials, powered by a global team of specialists who focus on supplying essential market information. We enable customers to make decisions with conviction and sustainable value in the long term.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content