Wood Mackenzie says a 30% increase in upstream spending will be needed to meet stronger oil and gas demand amid a delayed energy transition. The research firm warns that this scenario could strain supply chains, drive up costs and push Brent crude prices above $100/barrel by 2030.

Spending in the upstream sector may need to increase by 30% to meet the demands of a delayed energy transition, according to new analysis from Wood Mackenzie.

The research firm’s latest report, “Removing the tension: how upstream can meet the demands of a delayed energy transition”, examines the additional resources and expenditures required to meet sustained high demand for oil and gas.

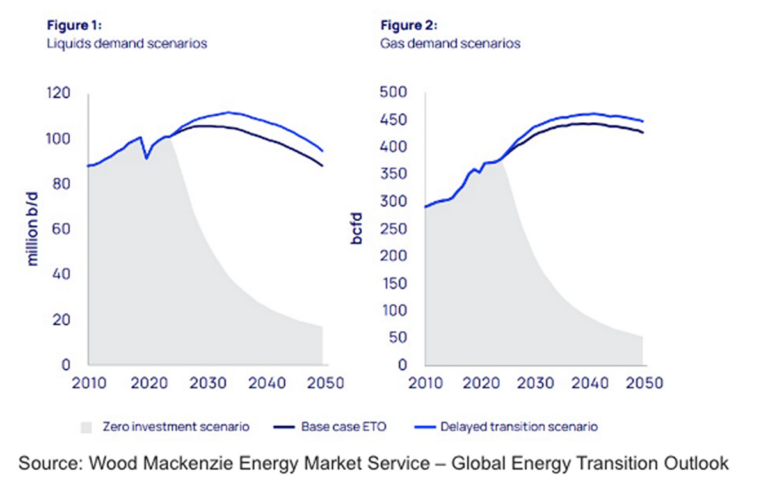

It said a delayed energy transition would increase global oil and gas supply needs by 5% and increase annual upstream capital investment by 30%. Liquids demand would average 6 million barrels per day (6%) higher than Wood Mackenzie’s base case through 2050, while gas demand would rise by 15 billion cubic feet per day (3%) over the same period, it said company.

Angus Rodger, head of upstream analysis for Asia Pacific and the Middle East at Wood Mackenzie, said stronger demand growth for a longer period of time would be a major challenge.

“A five-year transition delay would require incremental volumes equivalent to a new US Permian Basin for oil and a Haynesville Shale of Australia for gas,” Rodger said.

Wood Mackenzie said the global oil and gas sector could meet this demand with existing resources and future exploration, but would require significant investment. The analysts estimate that a 30% increase in upstream spending would increase annual development costs to $659 billion, compared to $507 billion in the base case.

The company also warned that increasing spending will not be easy, despite signs of increased demand.

“Increased activity would place significant pressure on the supply chain – parts of which are already operating near capacity – and project costs would increase,” the report said.

Fraser McKay, head of upstream analysis at Wood Mackenzie, said business planning prices would rise as the market outlook improves, with greater confidence in the longevity of demand.

“In that environment, higher development costs and breakevens would likely be acceptable,” McKay said.

Wood Mackenzie also predicted that higher supply costs could push up oil and gas prices. The company’s “Oil Supply Model” predicts that Brent prices will rise above $100/barrel in the 2030s in a delayed transition scenario, then fall to around $90/barrel by 2050 – on average around $20/barrel higher than the base scenario over the period.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.