Mercom Capital Group says inflation, high interest rates, trade disputes and policy uncertainty all contributed to a decline in corporate financing and merger and acquisition (M&A) activity in the solar energy sector last year.

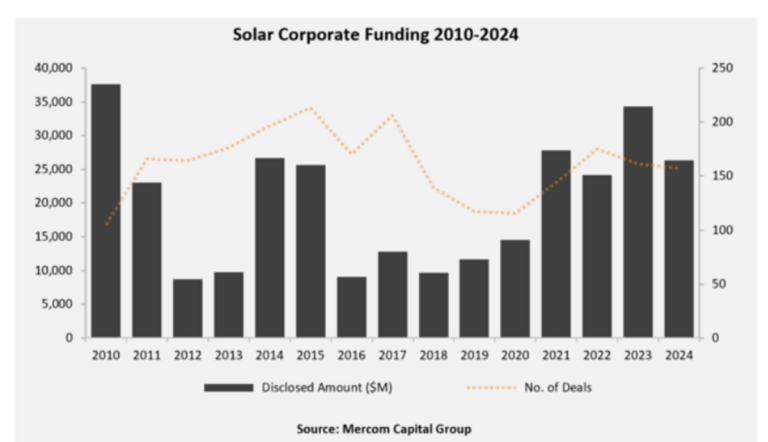

Corporate financing in the solar energy sector totaled $26.3 billion by 2024, according to figures released by Mercom Capital Group in its annual solar financing and mergers and acquisitions report.

The total figure, which includes venture capital financing, public market financing and debt financing, represents a decline of 24% from the $34.3 billion raised in 2023. The total includes 157 deals, compared to a total of 161 deals in 2023.

Solar venture capital financing totaled $4.5 billion in 2024, a decline of 36% from 2023 levels. A total of 87%, or $3.9 billion, went to 48 downstream companies in the field of solar energy.

Mercom found that the largest venture-backed companies in 2024 were Pine Gate Renewables ($650 million), Nexamp ($520 million), BrightNight ($440 million), Doral Renewables ($400 million), and MN8 Energy ($325 million).

Public market funding fell 59% year-over-year, reaching $3 billion in 2024. According to Mercom, nine companies went public in 2024, raising $1.3 billion, compared to seven companies raising $2.1 billion in 2023.

Announced debt financing reached $18.8 billion, down 6% from 2023 levels, but was supported by a record $5 billion in securitization declines.

“2024 was a year of uncertainties for the solar industry, with inflation, high interest rates, trade disputes and policy ambiguity contributing to a decline in financing and mergers and acquisitions,” said Raj Prabhu, CEO of Mercom Capital Group. “The market is waiting for clear policy signals from the new administration on the IRA provisions, ITC expansions and tariff measures before investors come off the sidelines and dealmaking can return to healthier levels.”

M&A activity in 2024 was 15% lower than the previous year, with 82 corporate transactions compared to 96 in 2023.

The largest transaction of the year was from Brookfield Asset Management, agreed jointly with institutional partners acquire a 53.12% stake in solar, wind and storage developer Neoen for $6.54 billion.

The number of large-scale solar project acquisitions in 2024 fell to 217, compared to 231 in 2023. Total acquired capacity also fell to 37.3 GW, down 17% from 45.4 GW the year before.

The only measure to reverse the trend was financing of large-scale projects, which Mercom found rose 21% from 2023 levels to $53.8 billion in 2024.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.