In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

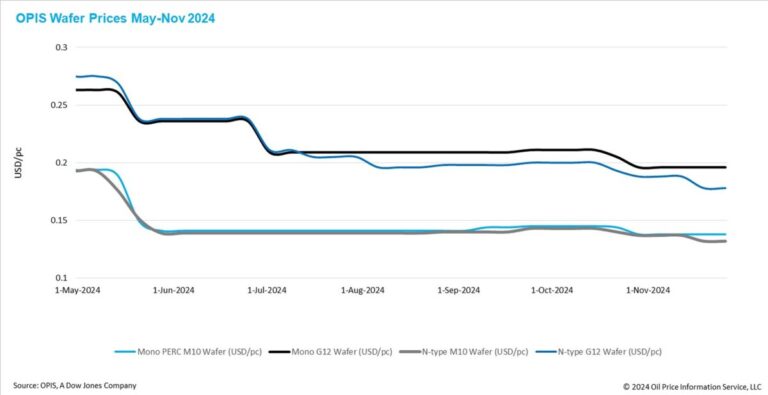

Mono PERC wafer prices in China remained stable this week, with Mono PERC M10 and G12 wafer prices at $0.138/pv and $0.196/pc respectively. Similarly, FOB China prices for n-type M10 and G12 wafers showed no weekly changes and remained stable at $0.132/pc and $0.178/pc, respectively.

The production of M10 wafers is reportedly carried out on a custom order basis without maintaining continuous inventory, thus ensuring relatively better profit margins compared to G12 wafers.

Amid widespread large-scale production cuts by Chinese wafer companies, reports emerged this week of a partial recovery in business figures at certain waffle factories. Industry insiders attribute this recovery in part to module manufacturers accelerating production material procurement to improve their production and sales performance for 2024.

In addition, under the revised Normative Requirements for the Photovoltaic (PV) Manufacturing Industry Guideline issued by the Chinese Ministry of Industry and Information Technology (MIIT) in July 2024, qualified solar energy producers are required to provide an actual annual production output realize at least 50% of their production capacity. production capacity for the same year. Insiders suggest that producers with persistently low business figures may need to increase production this year, as failure to meet this qualification could limit their future development prospects.

In the non-Chinese solar manufacturing market, only one U.S. integrated manufacturer is reportedly nearing production for its block project. All other announced block projects have yet to begin construction, leading industry insiders to believe that these projects are unlikely to reach production within the next two years due to the significant financing and complicated technological processes required for block production.

The international trade landscape has faced further challenges following China’s decision to reduce the export tax credit for solar products, including wafers, from 13% to 9% effective December 1. As a result, market participants expect a potential increase in prices for export orders. of Chinese waffles in the short term.

This policy is not expected to have a significant impact on export wafer demand as China remains the dominant global supplier and no viable alternative sources are currently available. However, both waffle sellers and buyers acknowledge that negotiating price increases remains a challenging process. The 4% price fluctuations pose a significant burden to both manufacturers and customers, especially in light of the ongoing market decline.

Sources believe it is unrealistic to expect customers to accept a 4% price increase overnight, noting that the specific pricing strategy is still up for debate. A gradual, step-by-step approach to price adjustments is currently being considered, especially for long-term and stable customers.

For orders for which the price is already known and which are to be delivered after December 1, wafer suppliers are also actively exploring the possibility of renegotiating prices with customers. Alternatively, some companies have adopted the strategy of hastily booking shipping space and clearing shipments through customs before December. However, this approach has limitations as early delivery depends on whether the customer’s location can accommodate it and whether it will incur additional storage costs for the customer.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content