KfW Development Bank has committed €24 billion to bridge the gap between high investment costs and low initial revenues for network operators in Germany.

The German national hydrogen strategy includes a 9,000 km hydrogen network by 2032, approved by the Federal Network Agency (Bundesnetzagentur).

Initially, network tariffs will ensure affordability for users, but operators face significant investment costs. KfW’s loan will fund an amortization account to offset shortfalls, with excess revenues repaying the loan once network costs exceed costs.

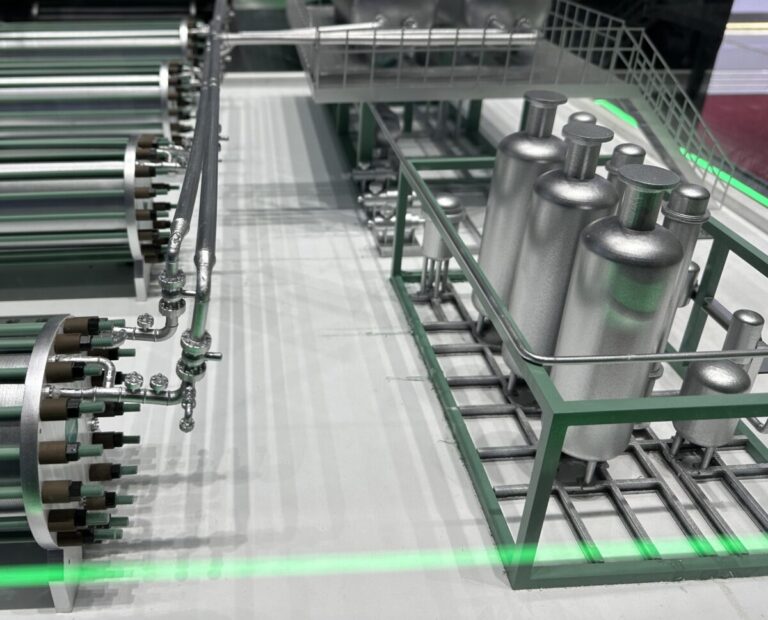

The network will repurpose existing gas pipelines and build new hydrogen lines, connecting production, import locations and industrial hubs. The first parts will be launched next year.

“The construction of the hydrogen core network is a groundbreaking project and crucial for the greenest possible deployment of hydrogen. The successful transition to hydrogen is a crucial factor, especially for energy-intensive industries,” says Stefan Wintels, CEO of KfW. “The depreciation account plays a key role in this: the resources that KfW makes available through the account make an important contribution to a viable financing concept for the hydrogen core network.”

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content