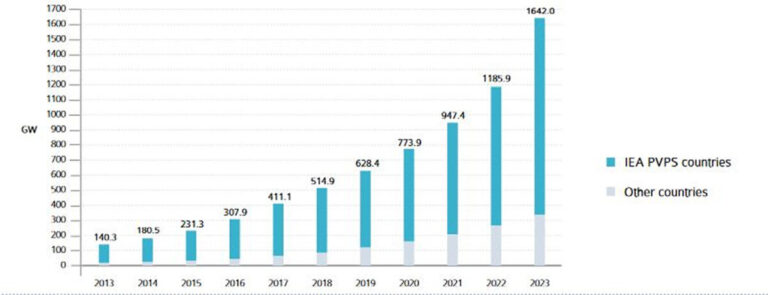

The global PV industry has grown tremendously in 2023, with unprecedented installation volumes reported throughout the year and even more expected for 2024, according to the “Trends in PV applications 2024report published by IEA-PVPS.

Unprecedented PV installations and China’s dominant market

China has led this expansion and has installed an astonishing amount of PV capacity to absorb the production surplus. Chinese installations alone account for more than 60% of global PV deployment, reflecting the country’s aggressive investments in renewable energy and its manufacturing capacity to meet both domestic and international demand. The report notes that while China is making progress, other regions are experiencing growth at a relatively modest pace, underscoring the concentration of PV power generation in the Chinese market.

Other regions, notably the United States and the European Union, have also made significant progress, although their figures remain lower than those of China. Countries such as Germany, Spain and the Netherlands in the EU are making remarkable progress, but are not yet approaching the scale of China’s efforts. These regional differences reflect differences in policy support, market demand and the logistical challenges each region faces in scaling up PV installations.

Inconsistencies in global PV statistics and capacity estimation

A particular challenge highlighted in the report is the lack of a uniform approach to measuring PV capacity worldwide. Different standards and methodologies, especially in the areas of AC/DC conversion rates, off-grid volumes and undeclared systems, lead to estimation differences between regions.

And in some cases, this discrepancy can be large enough to cause serious measurement ambiguities. In China, for example, the volume of capacity resulting from uncertainties about centralized AC/DC conversion is almost equal to the total number of installations in the entire EU and larger than that in the US. This discrepancy highlights the need for improved standardization in PV reporting practices to ensure accurate global comparisons and market forecasts.

Overcapacity and price declines: navigating market instability

The explosive growth in PV production has also created overcapacity, leading to a significant drop in PV prices, a trend that will continue into 2024. While this excess capacity benefits consumers by making PV systems more affordable, it has also put financial pressure on PV manufacturers.

China’s overcapacity has intensified competition, especially in the EU, where prices have fallen sharply due to surpluses of Chinese products targeting the European market after meeting domestic demand. The US and India have somewhat protected their markets from this impact through protective measures, highlighting the differences in the openness and competitiveness of the PV market.

In addition, manufacturers worldwide, including those in Europe and China, are increasingly struggling as older production lines become less competitive in the current market landscape. Many manufacturers are choosing to pause or close older production lines, reducing operating costs in response to tight profit margins. This consolidation reflects a maturing industry in which only the most efficient production lines remain operational, pushing companies toward technological innovation and cost efficiency.

Distributed PV growth and improved grid efficiency

The report shows that more than 40% of PV installations are distributed systems located directly at the point of consumption, minimizing energy loss compared to centralized energy sources. The distributed nature of PV allows it to effectively serve local communities, reducing transmission and distribution losses within electricity grids.

For this reason, PV is expected to account for 8.3% of global electricity consumption in 2024, compared to 5.4% of total production in 2023, underscoring PV’s efficiency in providing electricity to consumers with minimal loss. This distributed setup means that PV is well-placed to meet rising global energy needs with greater efficiency.

Rising PV penetration and the shift from marginal to basic power

An increasing number of countries are achieving high levels of PV penetration, with approximately 20 countries having higher PV penetration rates of more than 10%. This shift indicates that PV is evolving from a supplemental energy source used primarily for peak demand to a reliable source of baseload power.

The implications of this shift are substantial: PV is no longer just a means of offsetting peaks in electricity demand, but is now displacing traditional baseload generation methods, reshaping electricity grids and influencing energy policy and market dynamics.

Environmental impact and CO₂ avoidance

Reflecting the changing role of PV in electricity grids, the report’s methodology for calculating avoided CO₂ emissions has evolved. While in recent years PV was considered a compensation for peak power, it is now increasingly seen as a replacement for base load power. This adjustment in methodology reflects the greater impact of PV in high-penetration countries, where it offsets a significant portion of baseload power, rather than simply supplementing peak demand.

However, it is important to emphasize that the report’s CO₂ reduction estimates are not definitive studies. Rather, they serve as an illustrative guide for policy makers, industry players and end users who want to understand the role of PV in reducing emissions and meeting climate goals.

Conclusion: Shaping the future of global PV markets

The 2024 Trends Report provides valuable insights into the transformation of PV from a marginal energy source to a crucial part of national energy systems worldwide. The rapid rise of installations, especially in China, underlines the need for uniform capacity reporting standards and raises questions about market stability amid production overcapacity and fluctuating prices. As more countries adopt PV widely and as PV’s role in providing baseload energy grows, PV’s environmental and economic contributions continue to increase.

For market participants, policy makers and end users, these insights highlight both the immense potential of PV and the strategic decisions needed to support its growth and integration into global energy systems.

Authors: Melodie de l’Epine and Ignacio Landivar

This article is part of a monthly column from the IEA PVPS programme.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.